This year, since May, Reserve Bank of Australia (RBA) has hold out to any further easing of policy beyond current 2% interest rates and one of the key reasons for that has been excessive housing demand, fuelled by lower interest rates. Prices in Sydney were skyrocketing, so there rose significant risk of default in loans for speculative and investing purpose.

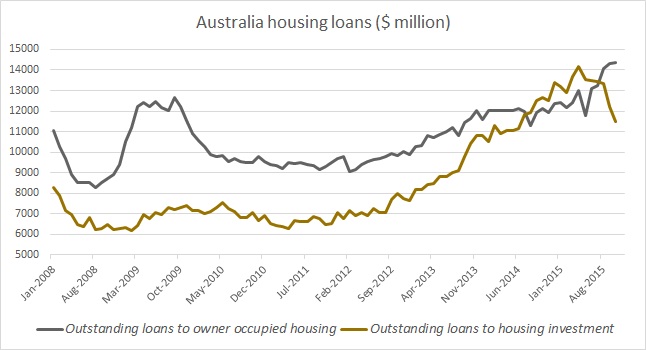

Loans issued by banks for investment purpose, just rose from $7 billion back in 2012 to $14 billion by early 2015. The size of outstanding loans issued for investment took over loans issued for ownership residential purpose by 2014. These were probably sufficient enough for RBA to address the issue and mention such in monetary policy statement.

However, latest data points that measures taken up by RBA and regulators to curb the growth for investing purpose, from both side seems to be working. RBA worked to make the banks more conservative towards investment lending, increased LVR to curb on the bubble buildup.

Latest data for October, point out, outstanding loans for investment purpose has dropped to $11.5 billion from their pick of 14.2 billion in April and since July outstanding loans for owner residential purpose has taken over the investing purpose outstanding.

Still the current improvement is not sufficient for RBA to focus fully towards further easing, more moderation towards $9 billion, would make the bank comfortable.

Australian Dollar is currently trading at 0.721 against Dollar.

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record