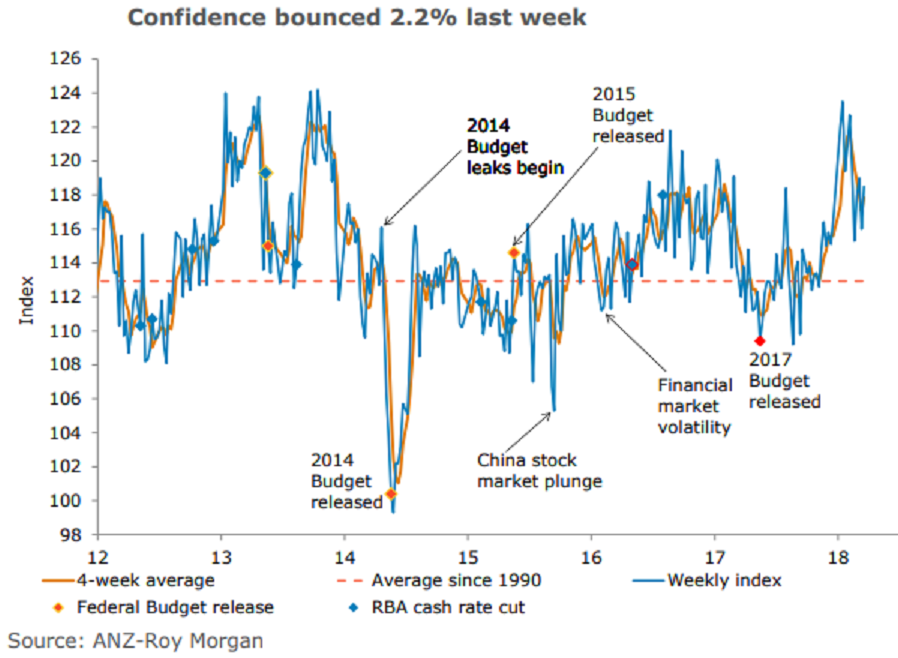

Australia’s ANZ-Roy Morgan Australian Consumer Confidence recovered 2.2 percent last week, largely reversing the previous 2.5 percent decline. The improvement in sentiment was broad-based, with households particularly optimistic about near-term financial conditions.

Views towards current economic conditions edged up 0.3 percent. This sub-index remains well above its long-term average. Sentiment around future conditions rose 1.2 percent, undoing much of the 1.9 percent decline in the previous week.

Household sentiment towards current and future financial conditions improved materially last week (6.4 percent and 2.6 percent, respectively), following consecutive falls in the two previous weeks.

Further, the 'time to buy a household item' sub-index rose 0.8 percent to 134.2. Inflation expectations eased to 4.5 percent on a four-week moving average basis, with the latest reading at 4.1 percent.

"Overall confidence seems to have stabilised after trending down in February. The jobs report out later this week has the potential to impact confidence in the near term. Another solid report with a tick down in the unemployment rate (in line with our expectations) is likely to support confidence, over the coming weeks. That said, confidence is vulnerable to additional bouts of financial market volatility," said Felicity Emmett, Senior Economist, ANZ Research.

Lastly, FxWirePro has launched Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals