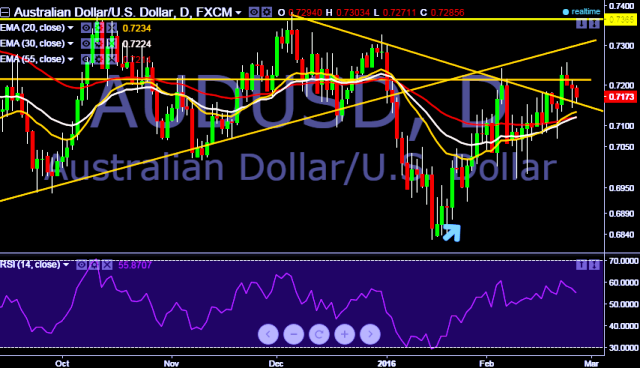

- AUD/USD is currently trading around $0.7168 levels.

- It made intraday high at $0.7201 and low at $0.7156 levels.

- Australia's total private capital expenditure rose 0.8% in the December quarter, the strongest rate in six quarters and better than the market forecast of a 3.1% decline. Aussie falls against the US dollar after the data released.

- Intraday bias remains bearish for the moment.

- A daily close above $0.7258 will turn the bias positive.

- On the other side, minor support level falls at $0.7145mark and below that may drag the parity around $0.7064 levels.

- Key support levels are seen at $0.7145, $0.71 and $0.7064 levels.

- On the top side, resistance levels are seen at $0.7213, $0.7258 and $0.7327 levels.

Positioning is inconclusive at this point, with prices offering no clear cut signal to initiate a long or short trade. We will continue to remain on sidelines for the time being.