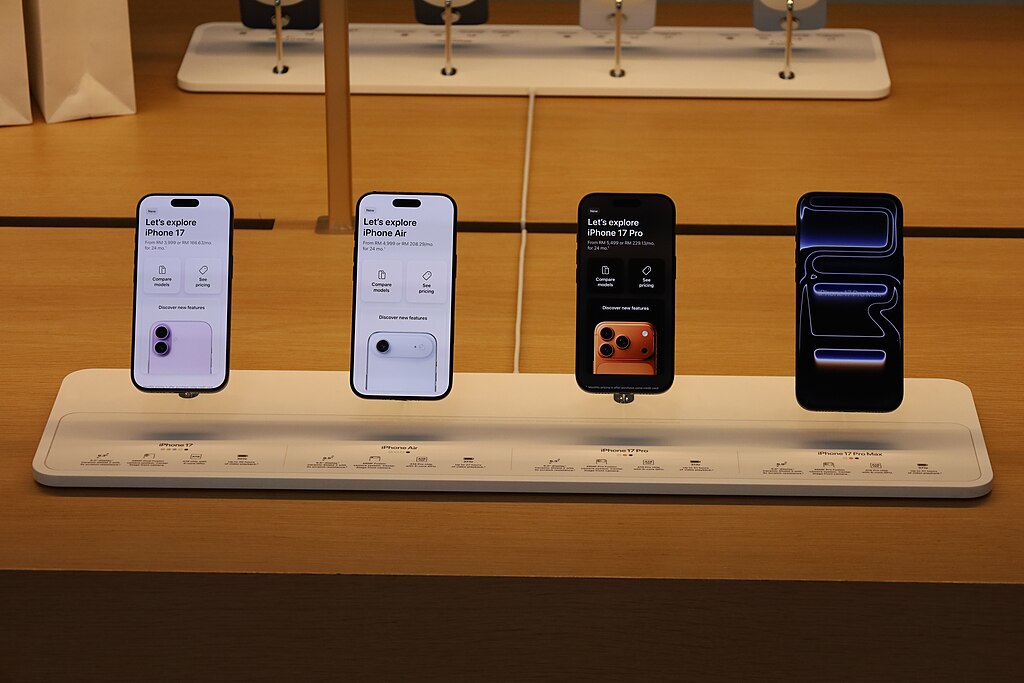

Apple briefly surpassed a $4 trillion market valuation for the first time on Tuesday, becoming the third major tech company to achieve the milestone after Nvidia and Microsoft. Shares climbed to $269.89 before closing slightly lower, giving Apple a market value of $3.99 trillion. The surge reflects renewed investor confidence driven by strong global demand for the latest iPhone 17 series and the new iPhone Air.

Since the September 9 product launch, Apple’s stock has gained 13%, marking its first positive momentum this year. According to Chris Zaccarelli, chief investment officer at Northlight Asset Management, the iPhone remains Apple’s core profit engine, reinforcing customer loyalty and deepening engagement in its ecosystem.

Earlier this year, Apple faced headwinds from competition in China and concerns over U.S. tariffs on its Asian manufacturing bases. However, strong early sales—particularly in China and the U.S.—have reversed much of that pressure. Research firm Counterpoint reported that iPhone 17 sales outpaced the previous model by 14%, while the ultra-slim iPhone Air is helping Apple hold ground against rivals like Samsung Electronics.

Evercore ISI analysts expect the robust iPhone sales to drive Apple’s performance above market expectations for the September quarter and strengthen forecasts for the December period. Despite challenges in the artificial intelligence space, Apple continues exploring partnerships with leading AI firms including OpenAI, Anthropic, and Google’s Gemini.

Although Apple’s delayed rollout of its Apple Intelligence suite and Siri’s AI upgrade has sparked concern, analysts suggest integrating AI effectively could significantly elevate the company’s market appeal. Apple’s shares currently trade at 33 times projected earnings, surpassing the Nasdaq 100’s multiple of 27. Despite lagging behind the Nasdaq’s 23% gain this year, Apple’s resilience and brand dominance reaffirm its position as one of the world’s most valuable companies.

CK Hutchison Launches Arbitration After Panama Court Revokes Canal Port Licences

CK Hutchison Launches Arbitration After Panama Court Revokes Canal Port Licences  SpaceX Seeks FCC Approval for Massive Solar-Powered Satellite Network to Support AI Data Centers

SpaceX Seeks FCC Approval for Massive Solar-Powered Satellite Network to Support AI Data Centers  Trump Backs Nexstar–Tegna Merger Amid Shifting U.S. Media Landscape

Trump Backs Nexstar–Tegna Merger Amid Shifting U.S. Media Landscape  Toyota’s Surprise CEO Change Signals Strategic Shift Amid Global Auto Turmoil

Toyota’s Surprise CEO Change Signals Strategic Shift Amid Global Auto Turmoil  Nvidia CEO Jensen Huang Says AI Investment Boom Is Just Beginning as NVDA Shares Surge

Nvidia CEO Jensen Huang Says AI Investment Boom Is Just Beginning as NVDA Shares Surge  SpaceX Prioritizes Moon Mission Before Mars as Starship Development Accelerates

SpaceX Prioritizes Moon Mission Before Mars as Starship Development Accelerates  Tencent Shares Slide After WeChat Restricts YuanBao AI Promotional Links

Tencent Shares Slide After WeChat Restricts YuanBao AI Promotional Links  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Global PC Makers Eye Chinese Memory Chip Suppliers Amid Ongoing Supply Crunch

Global PC Makers Eye Chinese Memory Chip Suppliers Amid Ongoing Supply Crunch  SpaceX Updates Starlink Privacy Policy to Allow AI Training as xAI Merger Talks and IPO Loom

SpaceX Updates Starlink Privacy Policy to Allow AI Training as xAI Merger Talks and IPO Loom  Amazon Stock Rebounds After Earnings as $200B Capex Plan Sparks AI Spending Debate

Amazon Stock Rebounds After Earnings as $200B Capex Plan Sparks AI Spending Debate  Nintendo Shares Slide After Earnings Miss Raises Switch 2 Margin Concerns

Nintendo Shares Slide After Earnings Miss Raises Switch 2 Margin Concerns  Instagram Outage Disrupts Thousands of U.S. Users

Instagram Outage Disrupts Thousands of U.S. Users  Prudential Financial Reports Higher Q4 Profit on Strong Underwriting and Investment Gains

Prudential Financial Reports Higher Q4 Profit on Strong Underwriting and Investment Gains  Elon Musk’s SpaceX Acquires xAI in Historic Deal Uniting Space and Artificial Intelligence

Elon Musk’s SpaceX Acquires xAI in Historic Deal Uniting Space and Artificial Intelligence  TrumpRx Website Launches to Offer Discounted Prescription Drugs for Cash-Paying Americans

TrumpRx Website Launches to Offer Discounted Prescription Drugs for Cash-Paying Americans