FOMC policy statement, participant's projection and dovish statement from FED chair Janet Yellen, successfully pushed back hike expectation, further into the future.

More participants and economists are now foreseeing first hike very late this year, some are even calling for hike in 2016.

- US economy hasn't picked up pace after slowdown in first quarter enough to warrant a rate hike by FED. So data now takes on center stage to determine whether FED will be comfortable enough to hike rates.

- As per FED chair Yellen job creation has fallen to average 210,000 this year so far, which is much lower than 280,000 seen last year. FED is most likely to see average job creation to reach close to 250,000 to consider going for first hike.

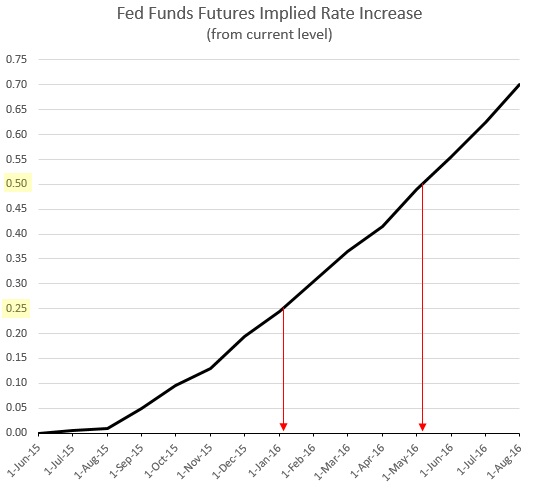

Naturally FED's dovish bias got reflected in FED' funds rate.

- FED funds future now forecasting first rate hike in January that remains in stark contradiction with fund managers among whom 54% think September is the most likely month for FED hike.

Either case dollar is likely to remain depressed for now.

Dollar index is currently trading at 93.7, down -0.62% so far today.

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?