Adidas AG is set to launch its second wave of Yeezy stock sales in August, following its split from Kanye West, now Ye, last year. The sports apparel giant confirmed that a portion of the proceeds will be donated to non-profit groups combating discrimination.

As per Business World, Adidas said it will be selling more Yeezy items in August, which will be its second wave of sales for the brand. The company said again that it would donate part of the total sales to non-profit organizations standing up and fighting against discrimination without mentioning how much it would give.

It was reported that some groups that will receive donations from Adidas are the Foundation to Combat Antisemitism (FCAS), the Anti-Defamation League (ADL), and the Philonise & Keeta Floyd Institute for Social Change. Moreover, some Yeezy shoes that Adidas sells in North America will also come with a square blue pin, the official symbol of Stand Up To Jewish Hate being run by FCAS.

It was late last year when Adidas pulled out Yeezy shoes and merchandise from its stores after severing its ties with Ye. The American rapper was involved in many controversies after launching a series of antisemitic remarks on social media and interviews, and this was what pushed the sneaker maker to end its 9-year partnership deal with him.

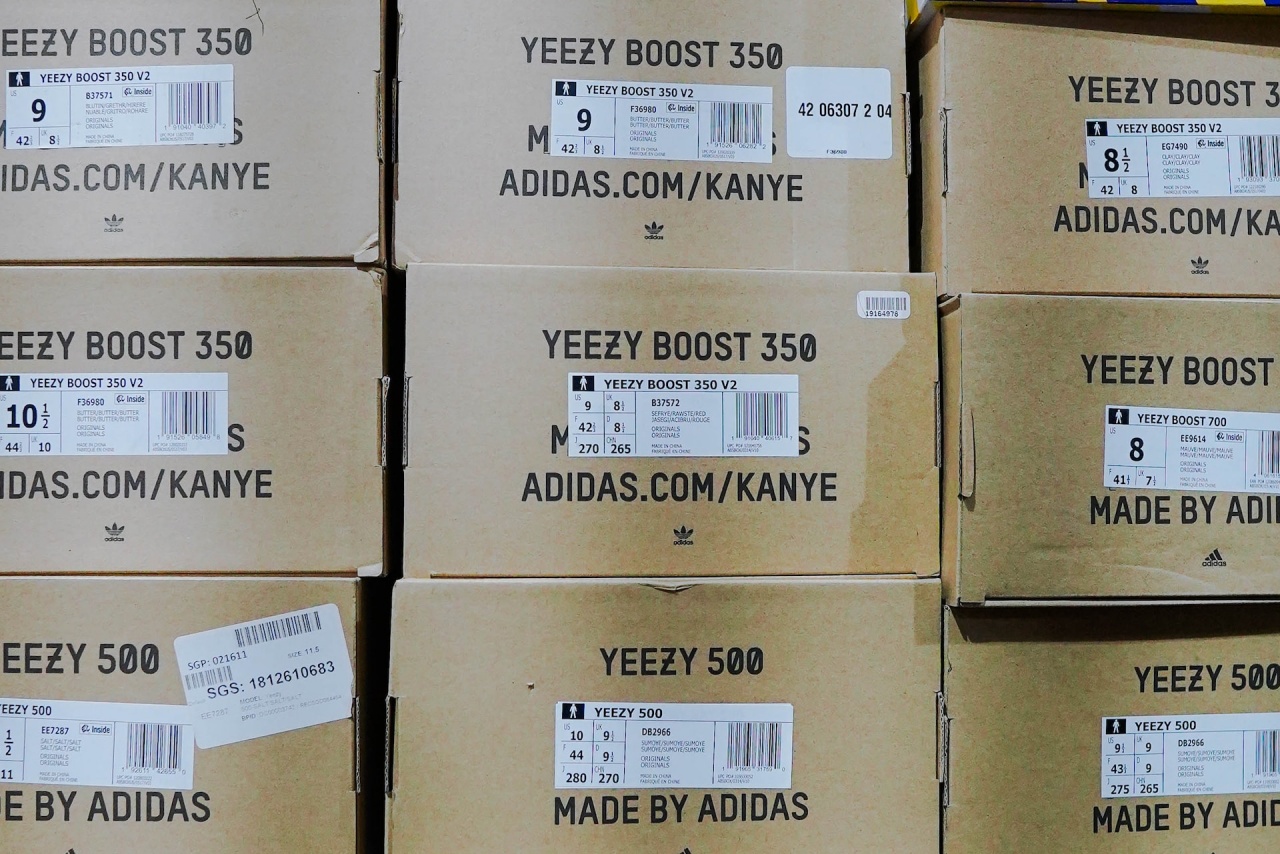

Adidas will start the online sale of Yeezy items on Wednesday this week through the company’s mobile app and website. Some sneaker models to expect from this drop are the Yeezy Boost 350 V2, 700, 500, and the Yeezy Slide and Foam RNR.

Meanwhile, Adidas’ released the first batch of stock sales for Yeezys, and it was reported last week that the company received huge orders of four million pairs. This boosted the company’s preliminary second-quarter financial results and reduced its operational losses.

Photo by: Alex Haney/Unsplash

SpaceX Pushes for Early Stock Index Inclusion Ahead of Potential Record-Breaking IPO

SpaceX Pushes for Early Stock Index Inclusion Ahead of Potential Record-Breaking IPO  Sony Q3 Profit Jumps on Gaming and Image Sensors, Full-Year Outlook Raised

Sony Q3 Profit Jumps on Gaming and Image Sensors, Full-Year Outlook Raised  Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  FDA Targets Hims & Hers Over $49 Weight-Loss Pill, Raising Legal and Safety Concerns

FDA Targets Hims & Hers Over $49 Weight-Loss Pill, Raising Legal and Safety Concerns  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  Tencent Shares Slide After WeChat Restricts YuanBao AI Promotional Links

Tencent Shares Slide After WeChat Restricts YuanBao AI Promotional Links  Once Upon a Farm Raises Nearly $198 Million in IPO, Valued at Over $724 Million

Once Upon a Farm Raises Nearly $198 Million in IPO, Valued at Over $724 Million  Rio Tinto Shares Hit Record High After Ending Glencore Merger Talks

Rio Tinto Shares Hit Record High After Ending Glencore Merger Talks  TSMC Eyes 3nm Chip Production in Japan with $17 Billion Kumamoto Investment

TSMC Eyes 3nm Chip Production in Japan with $17 Billion Kumamoto Investment  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  Thailand Inflation Remains Negative for 10th Straight Month in January

Thailand Inflation Remains Negative for 10th Straight Month in January  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  Amazon Stock Rebounds After Earnings as $200B Capex Plan Sparks AI Spending Debate

Amazon Stock Rebounds After Earnings as $200B Capex Plan Sparks AI Spending Debate  Nvidia CEO Jensen Huang Says AI Investment Boom Is Just Beginning as NVDA Shares Surge

Nvidia CEO Jensen Huang Says AI Investment Boom Is Just Beginning as NVDA Shares Surge  Instagram Outage Disrupts Thousands of U.S. Users

Instagram Outage Disrupts Thousands of U.S. Users