WTI is showing resilience in spite of breaking key support level at $43/barrel. It has since jumped up sharply

Key factors at play in Crude market -

- According to latest report, except for Permian region, in all other areas crude oil production is declining fast.

- However due to new technologies, crude oil production cost has declined for shale producers.

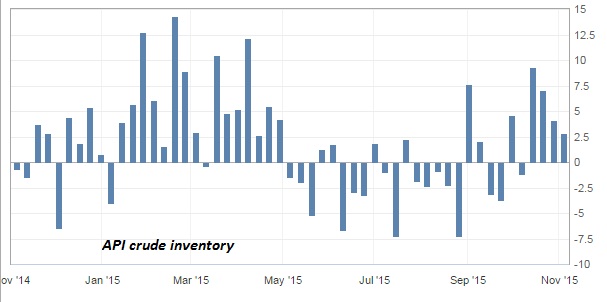

- Crude oil inventory has risen sharply over past few weeks. However surplus is declining steadily.

- Any cooperation is unlikely with Russia and Saudi Arabia fighting for market share in Europe.

- American Petroleum Institute's (API) weekly report showed inventory surplus by 2.8 million barrels, fourth consecutive rise in a row.

- Oil price is down, however lack of investments in the sector make prices vulnerable to supply shocks in future.

Today's inventory report from US Energy Information Administration (EIA), to be released at 15:30 GMT.

Trade idea -

- WTI is trapped between the bulls and bears and might require further fundamental cues to tilt the balance any particular side.

- Bulls are trying to push WTI towards $54.5/barrel for that call support/ stop loss around $42.5.barrel.

- On the other hand, bears are trying to push WTI towards $38.barrel, for that trade stop loss remains at $51/barrel area.

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate