ADP employment data to be released at 12:15 GMT is today’s most vital dockets from the US to be watched by market participants. This report is one of the key data that investors will use to gauge US economic strength.

What is ADP employment?

- The report is a measure of non-farm private sector employment which is obtained by utilizing an anonymous subset of roughly 400,000 U.S. businesses which are clients of ADP.

- This data is a very good measure of employment strength of the economy and a good precursor of Nonfarm payroll data.

Previous performance –

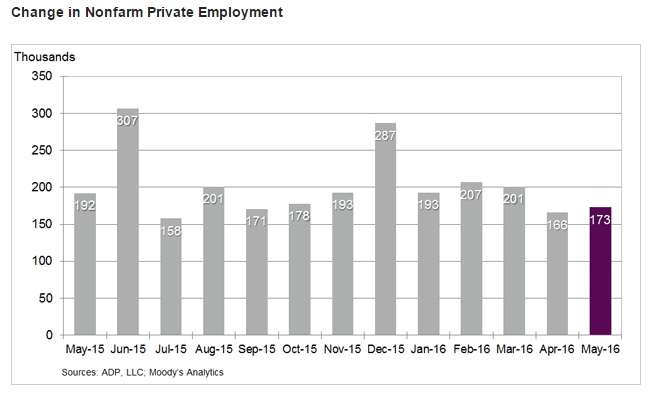

- Non-farm private sector employment grew at 173,000 in May. In April payroll grew by 166,000.

- Small business sector hiring at 76,000.

- Employment in franchise increased by 19,400.

- 3,000 jobs were lost in the manufacturing sector.

- 1,000 jobs were lost in the goods producing sector.

- Construction sector added 13,000 on payroll.

- 13,000 jobs were added in financial activities.

- Services sector remains job provider. Payroll added 175,000 people in May.

Expectation Today –

- The headline number is expected to rise to 159,000 as per median estimate.

Market Impact –

- Any gain above 200,000 will be considered to be very good and April and May drop to be temporary. The dollar might gain some support, however, the impact of stronger report unlikely to be much, especially with NFP to be released on Friday and due to Brexit threat.

- Data below 150,000 likely to give rise to concerns regarding US economic prowess and investors would have to consider, and there could be fresh run towards safety.

The dollar index is currently trading at 96.04, down -0.1 percent for the day.

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure  Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target