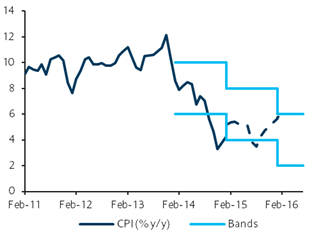

India has experienced considerable disinflation in the past six months. A combination of better controls over food prices, lower commodity prices (including oil prices), persistent idle industrial capacity, and a stable INR has resulted in CPI inflation declining from a peak of 8.6% in January 2014 to 3.3% in November, moving up only modestly to 5.4% by February 2015.

Barclays notes as follows on Friday:

- We now expect India' CPI inflation to average 6.0% in FY14-15 (from our earlier expectation of 6.6%), and to average 5.0% in FY15-16 (from 5.8% projected earlier).

- We expect inflation to average around 4.5% in 1H FY15-16, and rise to around 5.5% in 2H FY15-16. Our forecasts for a lower inflation trajectory are based on the following:

In 1H FY14-15, prices of both food and fuel were moving higher, while in FY15-16 we expect oil prices to remain low. Also, we assume a normal monsoon in 2015, which should help to keep food prices broadly stable.

2H FY15-16 will see adverse base effects, which could push inflation prints somewhat higher, although we still expect CPI to be below the RBI's early 2016 target of 6%.

Core inflation is likely to rise in coming months from the current low near 4% y/y, due to a higher services tax, a gradual improvement in industrial pricing power and expectations for a bottoming out in oil prices. However, we believe the uptick in core inflation in the coming months will likely remain modest.

We maintain our FY16-17 CPI inflation projection of 5.7%, with risks biased to the downside.

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022