In addition to asymmetric Fed reaction function, we believe risks to wage inflation may be also asymmetric and skewed to the upside.

In the US inflation options market, the liquid pillars are the 5Y and 10Y for ZC. For caps, liquidity can be found on the 2%, 3% and 4% strikes (the underlying is the US CPI), and on the 0% strike for floors.

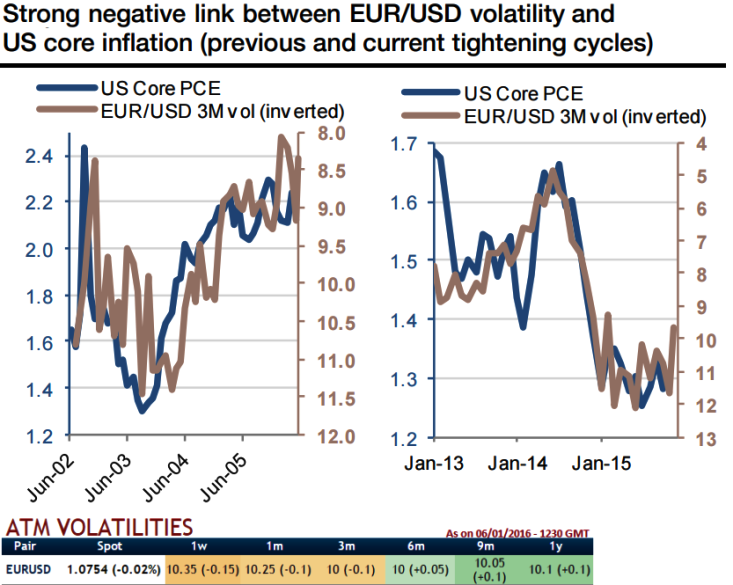

In our view, it's either inflation or volatility. FX volatility should stay contained by mounting US inflation expectations.

The least reasonable part of FOMC 2016 projections is only 0.3% decline in the unemployment rate given the structural decline in trend growth and labor force participation rate.

The Fed has explicitly conveyed that it emphasizes greater extents to the tightening of the domestic labor market than to disinflation pressures, so any pick-up in wage inflation should support the Fed's conviction in the appropriateness of further hikes.

Thus, it is very much understood that the projection for next 3-4 hikes in 2016, on the hawkish side of the market's implied distribution.

EUR/USD volatility is not linked to US inflation topside volatility but is strongly tied to the market price of deflation risk. In particular, FX volatility has increased since mid-2014 whereas the premium of caps has remained at a standstill.

More notably on the flip side, until there is real domestically-generated inflation in euro area, it is hard to call EUR sustainably higher. Headline inflation has been dragged down by energy prices but even core inflation is soft (particularly in Spain/other periphery countries).

Services inflation appears to have troughed but is yet to trend higher (services are 43.5% of consumption basket and depend more on domestic factors/wage pressures).

Eventually we think EUR recovers but it will be slow. Hence, EUR/USD volatility can be momentarily correlated to US core inflation, but in the medium term, it is linked to the uncertainty surrounding these expectations.

A glimpse on US inflation option market, FOMC in 2016 and EUR/USD vols

Thursday, January 7, 2016 7:28 AM UTC

Editor's Picks

- Market Data

Most Popular

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX