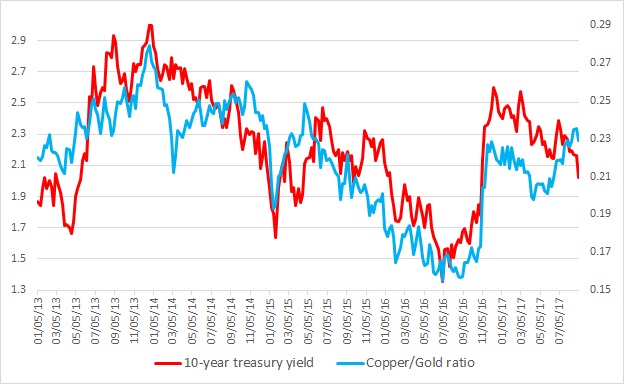

This chart shows the relation between the copper/Gold ratio and the U.S. 10-year yield constant maturity since 2013. It is visible even with the naked eye that the ratio and the yield have enjoyed a close relationship. Any divergence was temporary.

Last major divergence occurred back in 2014 when since March that year the ratio moved higher while the yield continued its decline. This continued until October before the collapse took place beginning November of that year.

What is the significance of the ratio?

- Copper is considered as an industrial barometer and pro-growth, while gold is considered as a safe haven and anti-growth. So higher ratio usually indicates increased economic activities, which in turn leads to higher interest rates/yield. Back in 2014, the ratio moved higher anticipating better than expected growth while yield moved higher but the ratio collapsed as the economy slowed down. Even the U.S. Federal Reserve had to lower its rate forecast.

Warning sign:

- A divergence is ongoing since April. The ratio has been moving higher while the yields are moving down. So the question is, how the divergence might end – higher yields or economic collapse.

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out