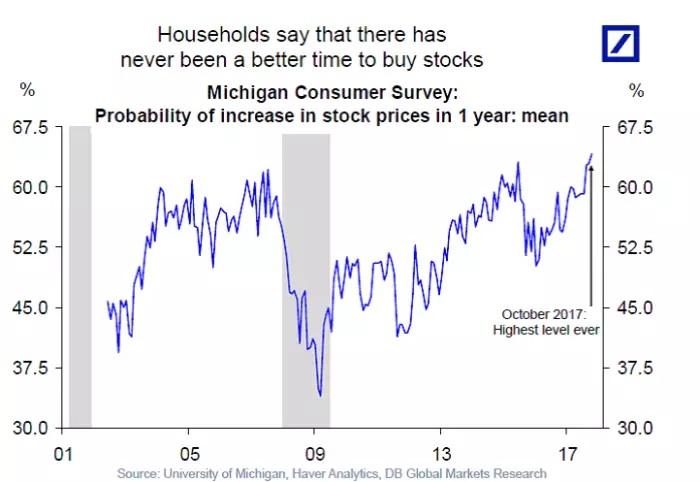

Deutsche Bank’s chief international economist Torsten Slock recently highlighted the above chart using data from Michigan consumer confidence that citing a contrarian indicator to alert investors on a potential stock market reversal. Though investors, analysts, and economists remain well-divided on the future of the current bull market which is already in its eighth year, the stocks have continues to rage higher. In a recent article, we highlighted that since 2009, at various occasions, analysts all around the world have predicted doom for the stock market citing reasons ranging from reflation, central banks’ monetary policy wind up to China’s debt trouble but none has been able to make a dent on the bulls for long. The U.S. benchmark stock index, S&P 500 has hit new highs this year and is currently trading at 2565, up close to 15 percent so far this year. In Europe, European Blue Chip Index, Eurostoxx50 has returned more than 10 percent. In Asia, Japan’s benchmark stock index Nikkei 225 is up 16 consecutive days trading at 21800, up more than 14 percent YTD.

Nevertheless, the contrarian indicators do call for caution or at least cautious optimism. The chart shows that the average consumer polled in October by the University of Michigan pinned the odds that stocks will rise at well over 60 percent, the highest level since at least 2002. Retail traders’ and general consumers’ sentiments are regarded as contrarian indicators, which have performed well historically.

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022