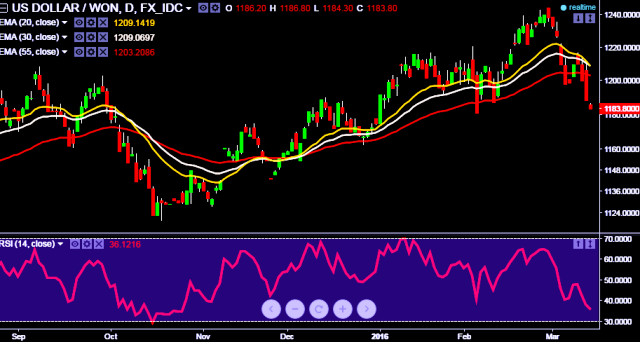

USD/KRW is currently trading around 1185.00 marks.

- Intraday bias remains bearish for the moment till the time pair holds key resistance at 1210 levels.

- Today Korea released Export and Import price index.

- South Korea’s February import price growth year on year decrease to -7.4 % vs previous -6.1 %.

- South Korea’s February export price growth year on year decrease to -2.0 % vs prev -1.3 %.

- Pair breaks key support at 1197 and likely to fall further.

- A daily close below key support at 1181 will drag the parity towards key support at 1166 marks.

- Alternatively, reversal from key support area will take the parity back above 1200/ 1217 marks.

We prefer to take short position in USD/KRW around 1185, stop loss 1200 and target 1166 levels thereafter.