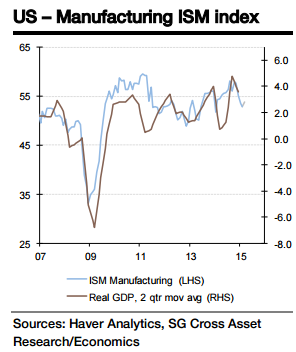

The US manufacturing ISM index is expected to show that manufacturing activity quickened very modestly in February. Roughly one point increase is expected in the index from 52.9 to 53.8. Data on manufacturing trends released to date offers a mixed picture.

The Empire and Philly Fed surveys were down slightly, however their components pointed to a slight improvement in conditions. Activity reportedly contracted in the Richmond Fed district; however the national Markit PMI posted its highest reading since October.

"Manufacturing activity improved modestly in March driven by better weather and to some extent by the reopening of West Coast ports. Our forecast, if realized, would be consistent with real GDP expanding at an annualized clip of about 2.5% in Q1", said Societe Generale in a report on Monday.

US manufacturing ISM index to increase slightly

Monday, March 30, 2015 9:15 AM UTC

Editor's Picks

- Market Data

Most Popular

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed