Today's release of Consumer price index (CPI) numbers will be most watched by traders and investors. CPI is scheduled to be released at 12:30 GMT.

Why important?

- FED's dual mandate is price stability and maximum employment. However, Unemployment rate has now reached 5.5% in US, which is considered as very close to long term level. That leaves inflation to be most vital for first rate hike as well as path.

- Moreover this is the most high profile release after FOMC yesterday. So the reaction stands very crucial.

Past trends -

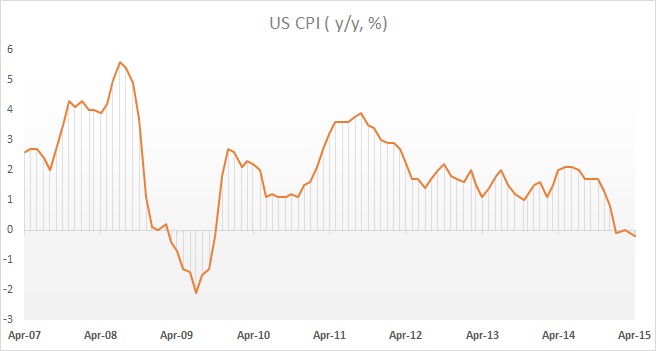

- CPI fell to negative territory in later half of 2014. In January CPI fell by -0.7% on monthly basis, mostly due to lower energy prices. CPI fell by -0.1% YoY in January.

- In April CPI dropped by -0.2% on Yearly basis, however grew by 0.1% on monthly basis.

- Core CPI so far has managed to keep its head above zero throughout last year. Core CPI grew by 0.2% in January and 1.6% YoY.

- In April, core CPI grew 0.3% m/m and 1.8% on yearly basis.

Expectation today -

- CPI is expected to rise by 0.5% mom and 0.2% yearly basis.

- Core CPI is expected to remain stable, growing at 1.8% on yearly basis.

Impact -

- FOMC participants has reduced flashed their forecast for growth and employment in 2015, however they maintained inflation expectation for rest of the year. If inflation fails to bounce back, it might dent FOMC forecast further longer.

- Dollar which has been falling since yesterday after FOMC turned out to be dovish might halt its slide if CPI surprise to upside. Weaker CPI would accelerate the slide.

Dollar index is currently trading at 93.69, down 0.65% today.

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand