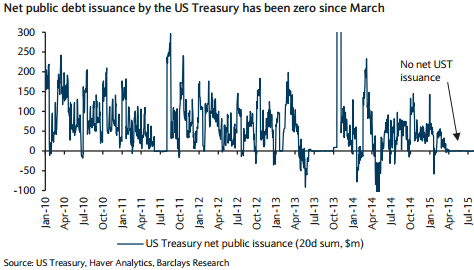

US Treasury net public debt issuance has been zero since March as tax receipts have been strong and spending relatively flat. Many investors are worried that the widening in investment grade corporate spreads points to an eventual correction in equities. As the credit strategists have pointed out, IG issuance is up considerably due to near-peak M&A and also buybacks, pressuring spreads, says Barclays.

In turn, record IG issuance combined with the lack of Treasury supply has left investors considerably overweight credit. Diversified US bond mutual funds have been reducing overweight credit positioning since the spring, which has weighed on the relative performance of credit.

"Positioning by their measure is still moderately overweight, which could continue to weight on spreads, but a moderation in the pace of IG issuance should provide some relief. Overall, we do not view booming corporate issuance amid a lack of Treasury supply because of a strong economy as a strong signal for a future equity correction", states Barclays.

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022