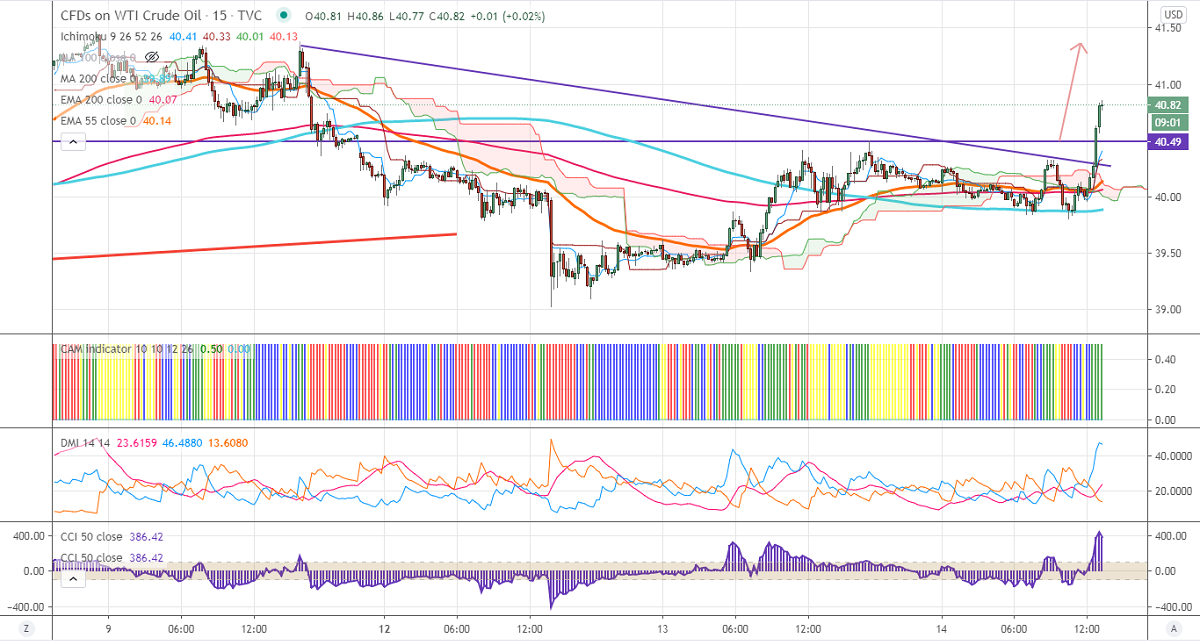

Ichimoku analysis (15 min chart)

Tenken-Sen- $40.24

Kijun-Sen- $40.22

US Oil continues to trade higher for the day and jumped nearly $1 in hopes of US fiscal stimulus. The US shale oil production is expected to drop 123K bpd to 7.69 mln bpd in Nov, according to EIA. The short term trend of oil is slightly bullish as long as support $39.86 holds. The intraday trend is on the higher side, a jump to $41.50 is possible.

Economic data:

Market eyes US EIA crude oil inventory data tomorrow for further direction. The annual US producer price rose to 1.2% in September compared to a forecast of 0.9%.

Technical:

In 15 min chart, US oil is trading well above the long-term moving average (200 MA) and Tenken-Sen, Kijun-Sen. Any break above $41 will take the commodity till $41.50/$42. On the flip side, near term intraday support is around $40.35 and any indicative break below that level will take the pair till $40/$39.85.

It is good to buy on dips around $40.55-60 with SL around $40 for the TP of $41.50.