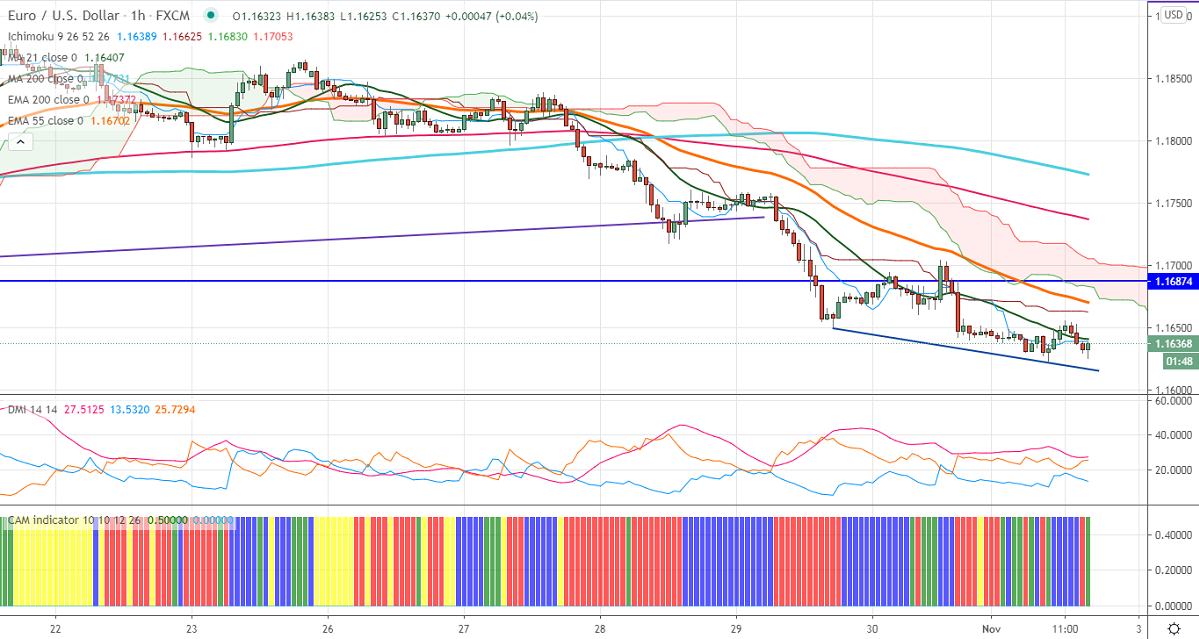

Ichimoku analysis (1 Hour chart)

Tenken-Sen- 1.16389

Kijun-Sen- 1.16633

EURUSD trading lower for the past four days and declined sharply below 1.16500 on upbeat US ISM manufacturing data. US ISM manufacturing jumped to 59.3 in October, better than the estimate 55.6. Markets eye US election first results which will be coming out on Wednesday for further direction. The rise in the number of cases globally has crossed 46m and the death toll crossed 1.20 m. The overall trend of the pair is bearish as long as resistance 1.1720 holds.

Technical:

In an hourly chart, EURUSD is trading below Tenken-Sen, Kijun-Sen. Any break above 1.16625 will take the pair till 1.17050/1.1720/1.1800/1.1880/1.19250. On the flip side, near term intraday support is around 1.16200 and any indicative break below that level will take till 1.1600/1.1580.

It is good to sell on rallies around 1.1660 with SL around 1.1700 for the TP of 1.1580.