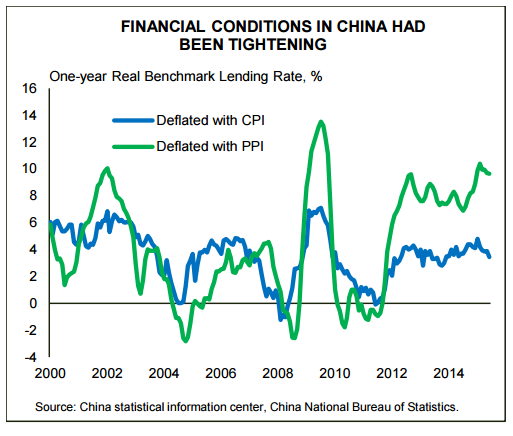

Chinese authorities are cognizant of the debt problem, and in response, monetary policy had been kept relatively tight. Although much of the world was easing policy, China kept interest rates unchanged until November 2014. With producer price inflation turning negative as a result of overcapacity and with consumer price inflation coming in very subdued, real interest rates rose.

In addition, the housing market turned south last year, and this has had knock-on effects on local government finances, which previously had relied on land sales to finance much of their budgets. Reforms at the local government level, while necessary, may also have had an impact on infrastructure spending. The result was that the Chinese economy stumbled in the first quarter of the year. Real GDP growth grew 7% year-over-year, its weakest since the first quarter of 2009, but growth on a quarterly basis fell to as low as 5.3%. Even these low numbers for China have come under suspicion. Real industrial production in particular - usually a solid indicator for gauging economic growth - has been gapping far below measured economic activity.

One of the clear examples of slower Chinese growth, and one of the most relevant for the rest of the world, can be found in international trade patterns. Import volumes declined for three consecutive months, tumbling 32% annualized in the first quarter, suggesting very weak domestic demand.

Weak import volumes in China have exerted considerable drag on the rest of the world. Real exports to the euro area rose strongly in the first quarter, while imports from the region weakened considerably. This partly contributed to the nearly 1pp (annualized) drag on euro area growth from net exports in the first quarter, in spite of the lower euro. Meanwhile, the U.S. trade deficit with China - which is little affected by currency movements given the Renminbi's de facto peg with the dollar - surged $6.4bn in Q1, the largest rise on record. Part of it may be related to West Coast port disruptions, but this occurred at a time of otherwise subdued U.S. domestic demand.

Tight monetary policy and reform efforts contributed to China’s growth slowdown

Thursday, July 23, 2015 10:30 PM UTC

Editor's Picks

- Market Data

Most Popular

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX