Samsung SDI has slashed the price of its new share issue by 17% following a sharp decline in its stock, triggered by broader market volatility and investor concerns over potential U.S. tariffs. The South Korean battery manufacturer now plans to issue new shares at 140,000 won ($100.37) each, down from the 169,200 won initially proposed in March.

This marks the second time the company has revised its pricing since the initial announcement of the capital raise, reflecting heightened market sensitivity and ongoing geopolitical risks that have weighed on investor sentiment.

The revised pricing aims to make the offering more attractive amid weakened demand, with the market responding negatively to trade policy uncertainty. The tariff speculation, particularly involving the U.S. and key Asian exporters, has amplified fears across global markets, pressuring stocks in the EV battery sector.

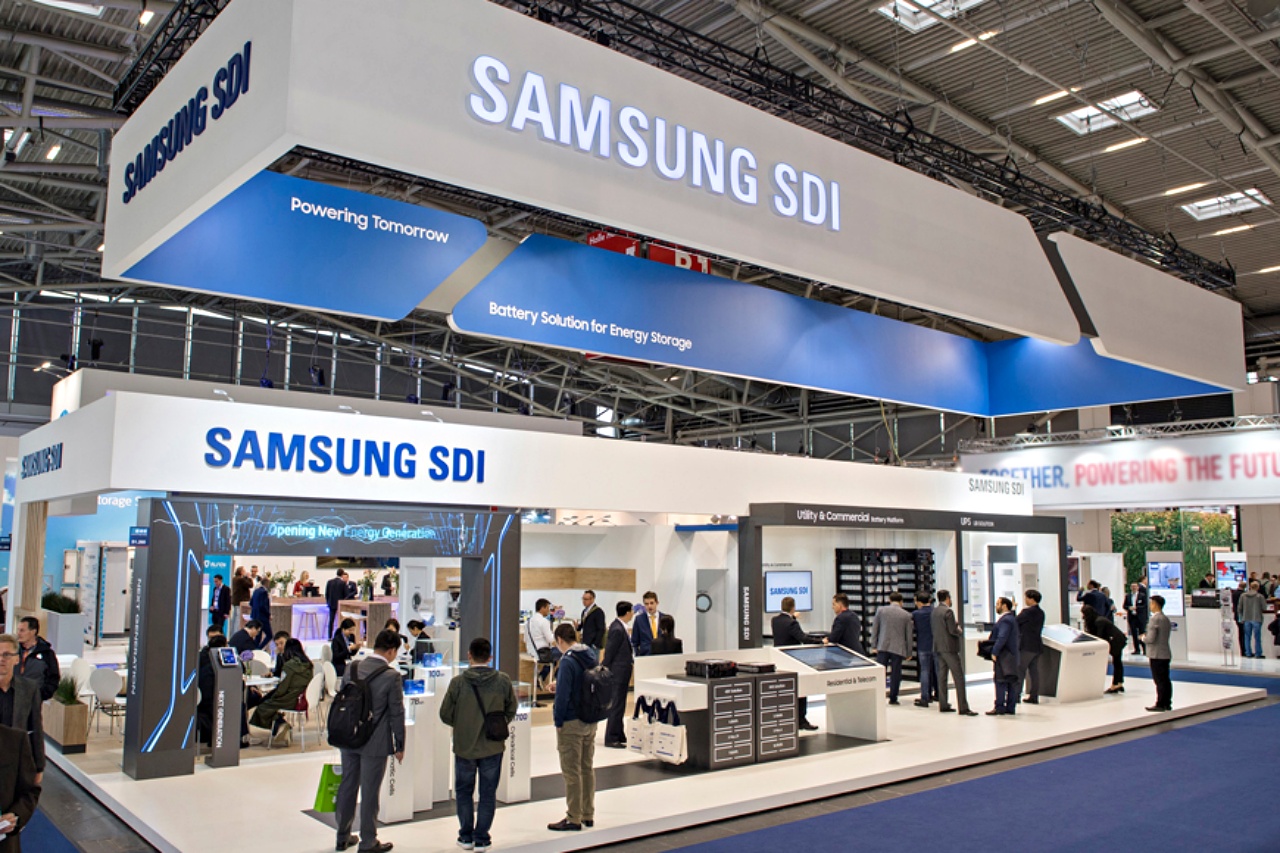

Samsung SDI, a major supplier for electric vehicle batteries and energy storage systems, is navigating a challenging macroeconomic environment. Despite solid long-term prospects driven by EV adoption, the company’s near-term fundraising efforts have been impacted by shifting investor appetite and increased market volatility.

Industry analysts say the price adjustment signals Samsung SDI’s urgency to secure funding for future growth, including capacity expansions and R&D, while maintaining shareholder interest. The move comes as battery competition intensifies globally, with rivals like LG Energy Solution and CATL also ramping up investments.

Investors will be closely watching how the revised offering affects Samsung SDI’s valuation and market positioning. The final impact on investor confidence may depend on the company's ability to deploy the capital effectively in its core battery business amid the evolving trade landscape.

OpenAI Expands Enterprise AI Strategy With Major Hiring Push Ahead of New Business Offering

OpenAI Expands Enterprise AI Strategy With Major Hiring Push Ahead of New Business Offering  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Ford and Geely Explore Strategic Manufacturing Partnership in Europe

Ford and Geely Explore Strategic Manufacturing Partnership in Europe  Toyota’s Surprise CEO Change Signals Strategic Shift Amid Global Auto Turmoil

Toyota’s Surprise CEO Change Signals Strategic Shift Amid Global Auto Turmoil  Once Upon a Farm Raises Nearly $198 Million in IPO, Valued at Over $724 Million

Once Upon a Farm Raises Nearly $198 Million in IPO, Valued at Over $724 Million  Baidu Approves $5 Billion Share Buyback and Plans First-Ever Dividend in 2026

Baidu Approves $5 Billion Share Buyback and Plans First-Ever Dividend in 2026  AMD Shares Slide Despite Earnings Beat as Cautious Revenue Outlook Weighs on Stock

AMD Shares Slide Despite Earnings Beat as Cautious Revenue Outlook Weighs on Stock  Rio Tinto Shares Hit Record High After Ending Glencore Merger Talks

Rio Tinto Shares Hit Record High After Ending Glencore Merger Talks  Nvidia Nears $20 Billion OpenAI Investment as AI Funding Race Intensifies

Nvidia Nears $20 Billion OpenAI Investment as AI Funding Race Intensifies  Instagram Outage Disrupts Thousands of U.S. Users

Instagram Outage Disrupts Thousands of U.S. Users  Alphabet’s Massive AI Spending Surge Signals Confidence in Google’s Growth Engine

Alphabet’s Massive AI Spending Surge Signals Confidence in Google’s Growth Engine  Tencent Shares Slide After WeChat Restricts YuanBao AI Promotional Links

Tencent Shares Slide After WeChat Restricts YuanBao AI Promotional Links  CK Hutchison Launches Arbitration After Panama Court Revokes Canal Port Licences

CK Hutchison Launches Arbitration After Panama Court Revokes Canal Port Licences  Sony Q3 Profit Jumps on Gaming and Image Sensors, Full-Year Outlook Raised

Sony Q3 Profit Jumps on Gaming and Image Sensors, Full-Year Outlook Raised  Amazon Stock Rebounds After Earnings as $200B Capex Plan Sparks AI Spending Debate

Amazon Stock Rebounds After Earnings as $200B Capex Plan Sparks AI Spending Debate  TrumpRx Website Launches to Offer Discounted Prescription Drugs for Cash-Paying Americans

TrumpRx Website Launches to Offer Discounted Prescription Drugs for Cash-Paying Americans  Prudential Financial Reports Higher Q4 Profit on Strong Underwriting and Investment Gains

Prudential Financial Reports Higher Q4 Profit on Strong Underwriting and Investment Gains