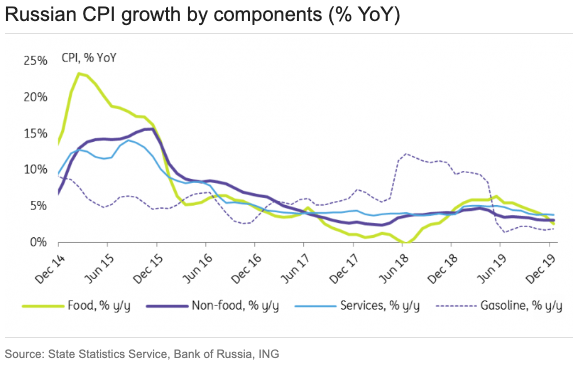

Russia ended 2019 on a disappointing note in terms of consumer price inflation (CPI), which dropped to 3 percent y/y, close to the Central Bank of Russia’s (CBR) lower target range and is expected to fall nearly to 2 percent on a temporary basis during the first quarter of this year, according to the latest research report from ING Economics.

Looking at the CPI composition, food products (38 percent of consumer basket) seems to be the sole disinflationary component, with food CPI slowing from 3.7 percent y/y in November to 2.6 percent y/y in December on a higher statistical base, while non-food CPI growth stayed unchanged at 3.1 percent y/y amid accelerating gasoline price growth, and services CPI decelerating only marginally from 3.9 percent y/y to 3.8 percent y/y.

Global grain prices, seem to be heading north again after showing a negative to flat y/y performance in the middle of 2019. Global wheat prices in US dollar terms were up 11 percent y/y in December 2019 and flattish in rouble terms, with roughly similar expectations for 1Q20, depending on RUB performance, the report added.

Inflationary expectations, as reported by the Bank of Russia, deteriorated in December both for households and corporates, which may suggest some reassessment of the CPI prospects after November's Black Friday promotional discounts.

In the meantime, the consumer sentiment index in December was reported at 95 points, which is 6 points higher than a year ago, while retail trade growth accelerated to 2.3 percent y/y in November, the highest level in 11 months, suggesting a lack of demand-driven constraints to CPI growth.

"While we agree that the likelihood of that scenario has increased, we still believe that the final decision will be a close call, and see the following arguments against a cut," ING Economics further commented in the report.

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  Thailand Inflation Remains Negative for 10th Straight Month in January

Thailand Inflation Remains Negative for 10th Straight Month in January  Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength