Since mid-last year, property prices in China is going through steady rise in prices. According to latest data overall property prices are up 3.6% in February. This price rise has been steady since mid of last year and China enthusiasts are getting excited once more. Many are calling that expansionary policies pursued by People’s Bank of China (PBoC) along with targeted policies such as reduction in down payment for house purchase in lower tiered cities, slashing taxes on properties.

However, key driver behind rise in property prices may not be policies and buying homes, rather speculative forces once more, at least erratic rise in prices suggests so.

- According to latest report, house prices in Shenzhen area was up 72% from a year back. It was up more than 3% on monthly basis. Similar was seen in Beijing and Shanghai, where prices were up more than 40% and 25% respectively. Per square meter space in Shenzhen Rea Estate now costs about 50,000 Yuan.

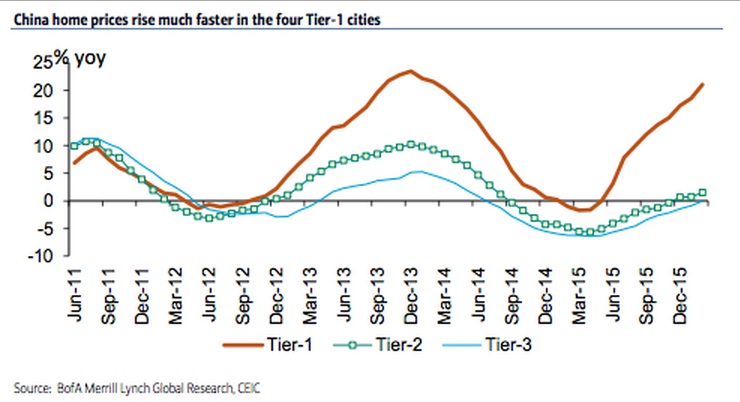

- Compared to the above figure, prices were up just 1.5% in Tier-II cities and prices actually dropped by -0.1% in Tier-III/IV cities. Latest chart from Bank of America Merrill Lynch (BofAML) shows the disparity in the housing market.

- Latest figures show, inventory absorption time, has come down steadily from their peak in fourth quarter of 2014 and it is further going down for Tier-I and Tier-II cities but it is increasing for Tier-III/IV cities.

China, despite being world’s second largest economy, large chunk of its people still lives in rural and semi-urban areas.

- These Tier – III/IV cities are where biggest chunk, more than 50% of property transactions take place. These are also the cities, where inventory levels are still on the higher side.

So, despite some overall recovery, prominent trend is that prices are over speeding in Tier-I cities like Shenzhen.

Recent stock market crash, corporate bond rally and rapid rise in house price inflation in few areas are strongly suggesting that large chunk of money looking to be invested.

Colorado takes a new – and likely more effective – approach to the housing crisis

Colorado takes a new – and likely more effective – approach to the housing crisis  Stamp duty is holding us back from moving homes – we’ve worked out how much

Stamp duty is holding us back from moving homes – we’ve worked out how much  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  What should you do if you can’t pay your rent or mortgage?

What should you do if you can’t pay your rent or mortgage?  Hong Kong's Housing Market Slumps for Fifth Month: What’s Next?

Hong Kong's Housing Market Slumps for Fifth Month: What’s Next?  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election