Since mid-last year, Reserve Bank of Australia, refrained from cutting rates below 2% and one of the key reason it cited was lower rates, helping fuel speculations in Australia’s property markets. With regulators, RBA took measures to curb speculative forces as it poses greater risks to the financial system, should the real estate melts down. Back in 2012/2013/2014, Banks’ loan growth towards the sector was rising sharply and lending for investments into real estate outpaced lending to own a home. After RBA took measures, bank’s loan growth for investment purpose has fallen but lending to ownership has kept rising.

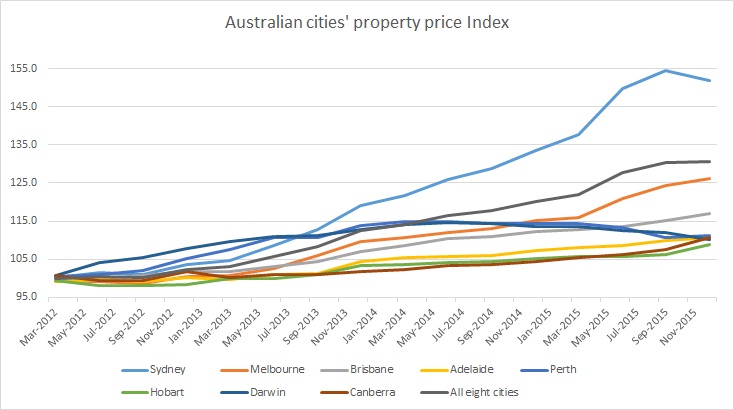

According to latest price figures released today, it seems Australia’s real estate segment is still posing risks to the overall economy. Simply because price has still remained elevated. Price may not be rising at the pace seen before, but rising nonetheless. Compared to March, 2012, prices are up more than 30% on an average in all eight cities. Prices in Sydney have risen more than 50%.

Risks still being on the higher side, we expect Reserve Bank of Australia to stand pat on rates, unless further deterioration occurs in Chinese front.

Australian Dollar is currently trading at 0.758 against Dollar.

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness