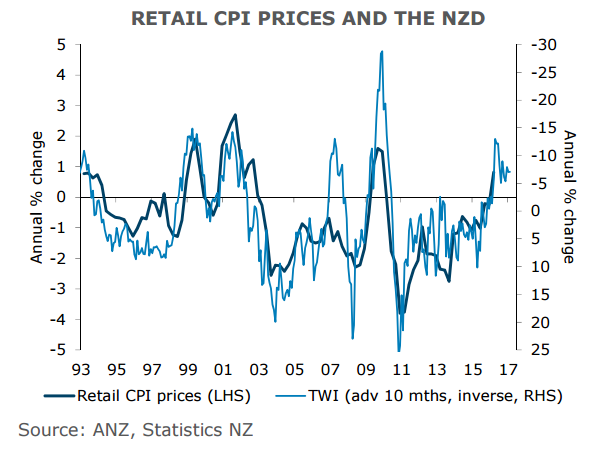

The Reserve Bank of New Zealand is scheduled to review its OCR on 28th April. Falling commodity prices and a recently stronger NZD have meant continued or increasing downward risks for New Zealand inflation. In the final quarter of 2015 inflation disappointed notably. At 0.1% y/y it was well below the RBNZ’s target area of 1-3%. Against this background, in March the RBNZ lowered key rates by 25bp to 2.25% and kept the option open for further monetary policy easing should the return to the inflation target be at risk.

Statistics New Zealand data released on Monday showed that NZ consumer price index had risen 0.2 percent in the first quarter, higher than the 0.1 percent expected by analysts. Year on year came in line with expectations at +0.4% and 0.1% previous. Inflation matched the Reserve Bank's estimates, stoking speculation the bank will wait until the June 9 release of its monetary policy statement to cut the official cash rate.

"This data detracts from the case for an April OCR cut. The details of the data will constitute a small upside surprise from the RBNZ's perspective. Non-tradables inflation, which is generally considered more important for monetary policy, was stronger than the RBNZ expected," Westpac senior economist Michael Gordon said.

Traders changed their bets on timing after the CPI figures were released, with 43 percent expecting a cut this month and 57 percent seeing the OCR unchanged at 2.25 percent. Before the data more expected a cut this month.

That said, the Kiwi is trading well above the levels the RBNZ considers justified in view of weak export prices. Trade weighted NZD index was in March traded more than 4% above the level the RBNZ had assumed in its forecast in December. Today, the New Zealand dollar initially tumbled but recovered ground after the CPI was released, keeping the central bank on track to cut interest rates in the next two months.

"While the data certainly doesn’t rule out the RBNZ cutting the OCR again next week, we don’t see it as the smoking gun that the market was hoping it would be. We continue to see the OCR going lower, but we are wary of the trade-offs this will bring," said ANZ in a report.

New Zealand Dollar edged higher against its major counterparts. NZD/USD was trading at 0.6942 and AUD/NZD was at 1.1105 at 1130 GMT. The two-year swap rate was unchanged at 2.24 percent and 10-year swaps fell 4 basis points to 2.91 percent.

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions