Following stronger-than-expected Q2 GDP report, the market sees only a small chance of a September cut, especially given the absence of MPR and press-conference, which is consistent with our call.

Taking a longer-term view, however, there is room for a further rally in the front end as the selloff in oil and other commodities since June may lead the Bank to revise growth projections lower and proceed with further policy easing.

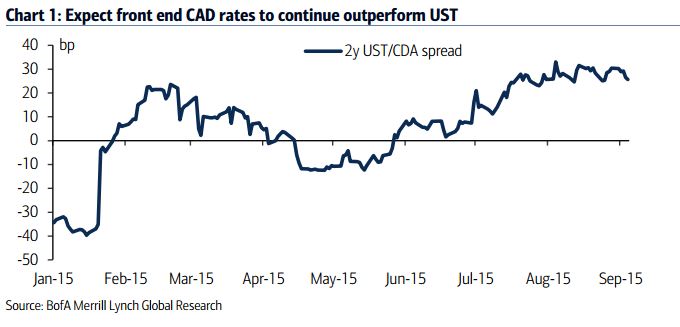

BofAML's FX strategists expect the continuation of CNY devaluation later this year, which is likely to put further downward pressure on commodity prices. "In contrast to Canadian rates, risks to front-end US rates are skewed toward a selloff, in our view," noted BofAML.

The market pushed out the perceived timing of the first Fed hike to Q1 2016, but BofAML economists do not expect such a long delay given the tighter US labor market. Although the spread between 2-year USD and CAD rates already trades at the upper bound of the historical range, it is expected to widen from the current levels if the policy divergence is realized.

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022