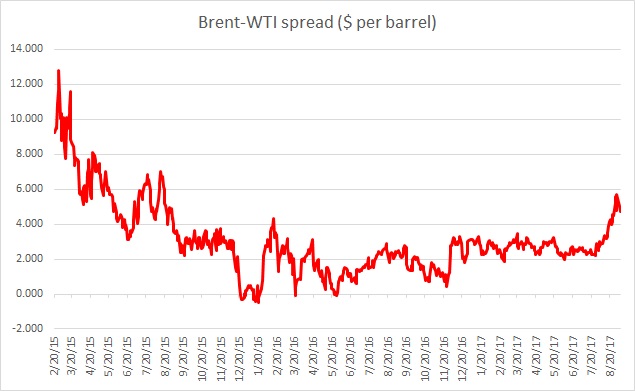

The spread between two most widely used oil benchmarks, North American WTI and North Sea Brent is easing after it reached the highest level in 24 months thanks to the disaster caused by Hurricane Harvey last week that led to closure of all ports in the Gulf Coast and led to Refining capacity shut down in the tune of 4.9 million barrels per day. Last week, the spread reached as high as $5.8 per barrel, which is the highest level since August 2015. WTI, which was a big loser last week as oil produced in the United States remained land locked, away from refineries, is slowly gaining grounds, while Brent has lost some of its shine. WTI is currently trading at $48 per barrel and the spread is at $4.7 per barrel.

Gasoline price is also moderating this week, after reaching the highest level of 2017 last week. Contracts for September delivery rose as high as $2.18 per gallon before expiry while cash market price reached as high as $2.52 per gallon. However, the situation is moderating as many refineries reopened to process crude and the U.S. Department of Energy supplies millions of barrels of crude oil to refineries that are starving of crude. As of latest report on Monday afternoon in the United States, more than 50 percent of the closed refineries have reopened and only 2.1 million barrels capacity still remains closed. Gasoline price for October delivery is currently trading at $1.693 per barrel.

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX