The FY2019 (fiscal year ending March 2019) union budget, due next Thursday, February 1, will be the last full year budget of the Modi government before the general election in 2019. It will also be the first full-year budget under the GST regime.

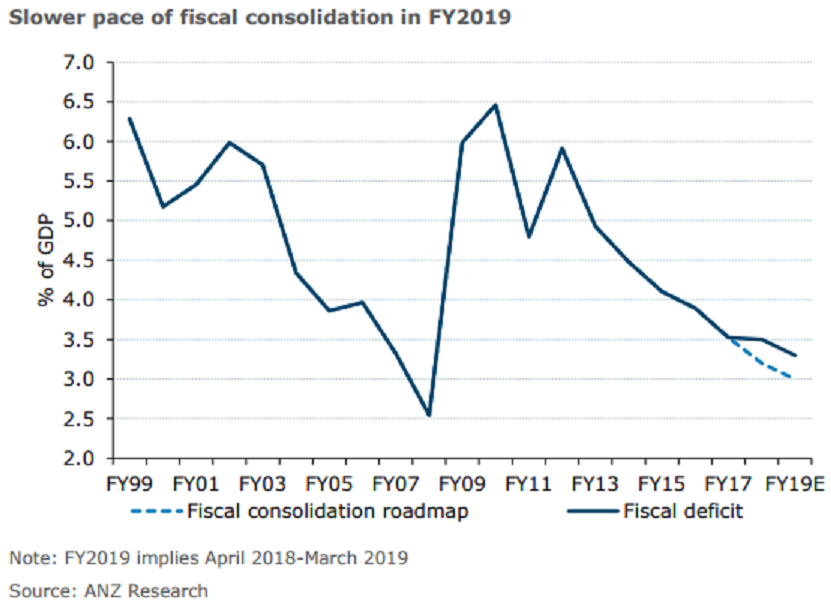

The government expected FY2019 fiscal deficit at 3.3 percent of GDP, higher than that what the initial medium term consolidation path had warranted. For FY2018, fiscal deficit is expected at 3.5 percent of GDP versus the government’s target of 3.2 percent. Also, the fiscal stance is unlikely to be inflationary on its own. The fiscal slippage in FY2018 is an outcome of lower-than-expected revenues rather than higher expenditure.

Additionally, the expenditure mix in FY2019 budget is likely to show steady growth in capex, which is less inflationary compared with revenue expenditure. Further, the CPI is expected to average 5.1 percent in FY2019, higher than our estimate of 3.6 percent in FY2018.

"We continue to expect the central bank to keep the repo rate at 6.00 percent in 2018. However, it is likely that the underlying rhetoric in the policy statements will remain hawkish," the report added.

Lastly, FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

UK Starting Salaries See Strongest Growth in 18 Months as Hiring Sentiment Improves

UK Starting Salaries See Strongest Growth in 18 Months as Hiring Sentiment Improves  Gold and Silver Prices Climb in Asian Trade as Markets Eye Key U.S. Economic Data

Gold and Silver Prices Climb in Asian Trade as Markets Eye Key U.S. Economic Data  Asian Currencies Stay Rangebound as Yen Firms on Intervention Talk

Asian Currencies Stay Rangebound as Yen Firms on Intervention Talk  U.S. Stock Futures Rise as Markets Brace for Jobs and Inflation Data

U.S. Stock Futures Rise as Markets Brace for Jobs and Inflation Data  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices