1 - 3 Month Outlook

Despite the BoJ not delivering the additional QQE that many expected on October 30, JPY ended the month lower against most other G10 currencies and USD/JPY ended toward the top of the two month range. In reality, JPY underperformance in October reflected the reversal of the global risk-off move that started in August and USD/JPY has continued to trade as a risk proxy though the re-risking that followed. With risk premia now heavily compressed and risky asset prices back to early-August levels, there is a reasonable prospect of fundamental factors driving JPY price action through the reminder of the year and into early-2016. Those factors remain JPY negative.

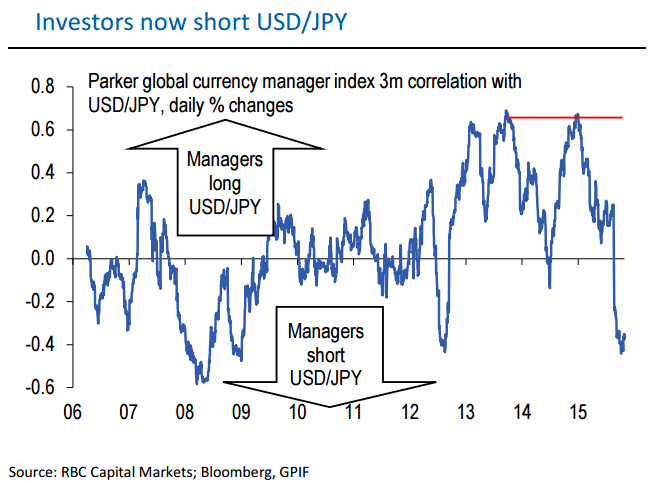

Although the BoJ kept policy unchanged at the late October meeting, it went out of its way to stress that there are no technical impediments to further easing and all policy options remain open going forward. Further BoJ easing, however, is not critical to the case for JPY weakness. Equity-related capital outflows remain strong and persistent (averaging around JPY300bn/week) and have much further to run than is generally perceived. Moreover, the capacity of overseas investors to absorb the JPY selling this induces is much reduced. Not only have JPY shorts outside Japan now largely been covered, some sectors now appear to outright long JPY for the first time in three years. In the remainder of the year, a steady grind higher in USD/JPY is expected, back to the August highs around 125.

6 - 12 Month Outlook

The capital outflows referred to above will remain JPYnegative for at least another year. Contrary to the widespread view that the GPIF reallocation is "close to completion" many more months of outflows are seen. GPIF is only around half way through its reallocation of cash into foreign equities and has around another JPY6trn yet to do. And this figure does not include other public pension funds that follow GPIF and will only start reallocating this month (JPY30trn of assets in total) or a similar reallocation by soon-to-be privatised Yucho and Kampo. And private sector investors are expected to start selling JPY (via lower hedge ratios) as US rates start to rise. Overall, the case for USD/JPY trading much higher in the long-term remains compelling. With little evidence that corporate Japan is benefitting significantly, however, valuation is not sen as a constraint on further losses.

Japanese Yen Outlook

Thursday, November 5, 2015 10:34 PM UTC

Editor's Picks

- Market Data

Most Popular

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX