Market participants rightfully pay considerable attention to individual items in the BLS' CPI report. However, those with their hands on the levers of monetary policy remain more concerned with their implications for PCE chain-weighted cost measures.

"Running the seasonally adjusted CPI forecasts through our PCE inflation models, the latter's headline measure is expected to climb by 0.2% as well in July, after a similar increase in the previous month. In contrast to the CPI excluding food and energy components, the core PCE chain price index is expected to have edged just one tick higher for a fourth consecutive month", says Societe Generale.

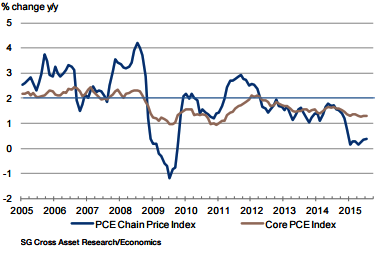

These projections, if accurate, would leave the headline and core PCE deflators 0.4% and 1.3% above their respective year-ago levels, both well shy of the FOMC's stated 2% objective.

"Given the most recent declines in retail energy costs, the gap between the annual growth rates of the total and core PCE inflation gauges since last fall that likely will continue over the months ahead and may not close until the second half of 2016", added Societe Generale.

Implications for policy sensitive US consumer inflation gauges

Wednesday, August 19, 2015 5:09 AM UTC

Editor's Picks

- Market Data

Most Popular

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022