In the hope of cooperation among global oil producers both OPEC and non-OPEC, has lifted oil price form 13 year low and from the bottom as of today, North American benchmark WTI is up more than 20%. As of now, the gulf delegates, led by Venezuela has been able to achieve production freeze at January level by Russia and Saudi Arabia, two of world's largest producers. Iran hasn't agreed to any production freeze as of now but it wasn't expected also.

Oil market has remained buoyed in hope of further progress and it has been quite positive for equity markets so far.

S&P 500 has gained after double bottoming around 1815 area and currently trading at 1927.

However this rise in oil price may not bear well for treasuries, which might drop with rise in oil and push yield higher.

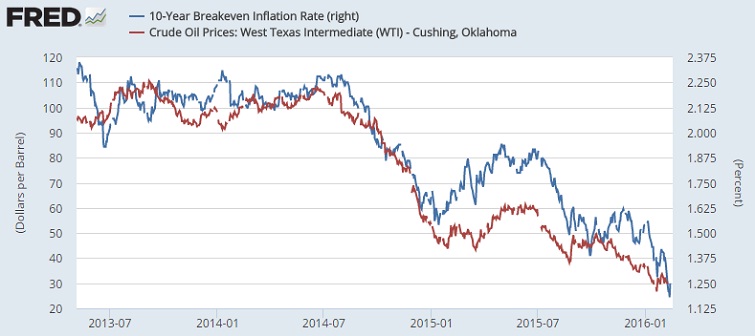

Key theme behind such will be inflation expectations, which has shown high correlation to oil since mid-2014. As oil price dropped from above $100/barrel, inflation expectation has dropped about 110 basis points. So with rise in inflation expectations, investors even if seeking safety, could pile up money into treasury inflation protected securities (TIPS). Moreover, with rise in oil price, equity prices would bounce back too, reducing the demand for safe havens such as treasuries.

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022