GPIF's Q3 schedule results a 5.6% loss, which called into question the insight of the reallocation into foreign equities that has been ongoing for a year.

Subsequently, the news reports imply a potential switch to FX-hedged foreign asset holdings.

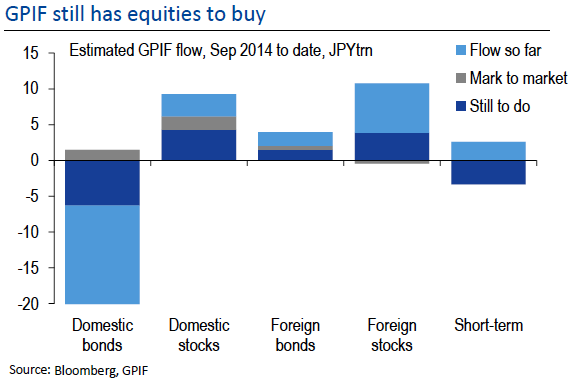

Given GPIF's fixed aim of increasing the share of equities to 25% each domestic and foreign, the implication going forward is that GPIF will have to buy even more risky assets as the market calms down the improvement it has made so far.

As a result, Yen may pretty much gain out of lots of uncertainties such as Chinese slowdown, to confirm this fear Caixin services PMI has dropped from previous 51.2 to 50.2 to miss the forecasts at 52.3.

USD/JPY rebuilt some upside momentum in November as US rates markets moved to re-price a December Fed hike, but the risk-off markets in early-December pulled it back to the middle of the recent range.

Forecasters are losing faith in JPY weakness and for the first time in at least five years, consensus forecasts are not calling USD/JPY higher, with both Bloomberg's and Reuters' analyst surveys now showing a profile essentially flat at spot.

So, although bearish we are bearish bias we advise contemplating the all other parameters, even you are extremely bullish on this currency cross, the anticipations for USDJPY should not exceed more than 126 in Q1, 128 in Q2 & 130 in Q3, thereby these levels can act as a resistance levels for this pair.

GPIF signals USD/JPY bulls as to why 130 levels act as headwind

Wednesday, January 6, 2016 7:52 AM UTC

Editor's Picks

- Market Data

Most Popular

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate