After all the uncertainty about Trump’s future plans for the economy is still high at present so that some doubts about the Trumpflation story are justified.

The markets have been squarely focussed since the election on a pro-risk loosening in fiscal policy and corporate deregulation, but the positive impact on risk sentiment and cyclical crosses such as AUDJPY could yet be reversed should the new Administration deliver on its protectionist agenda, as Trump’s choice of personnel to oversee trade very much suggests it intends to do.

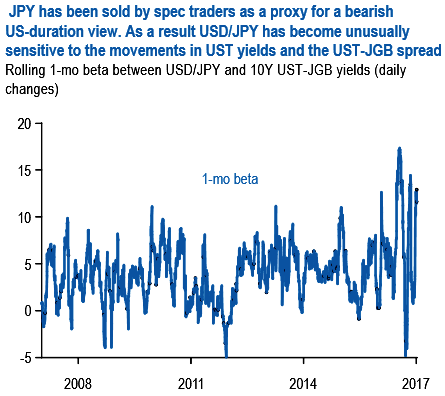

Aside from the trade issue, the yen remains highly sensitive to US yields (the beta of USDJPY to UST yields is the highest in a decade – see above chart), not so much because Japanese investors are taking advantage of higher yields (they have divested out of foreign bonds since the US election – refer the second chart), more that short-term traders regard USDJPY as an effective proxy for a short US duration view given the BoJ’s cap on JGB yields (GTJPY5Y:GOV JGB 5 Year Yield - 0.13%).

Having mentioned that, mounting global inflation, lifting US long yields, and persistent uncertainty elect the dollar as the winner. Uncertainty is however, unlikely to lift volatility until the environment turns risk-off. Trump’s victory has so far not been conducive to such a shift. Sell the yen and volatility.

Speculative participation in the yen sell-off is consequently high (IMM shorts are the largest since summer 2015), but so too the risk of a deeper squeeze on positions should there be any trade action from Trump from day one.

This week’s CNH shenanigans may also curb the market’s enthusiasm to hold large JPY shorts.

Hence, we advocate shorts in AUDJPY through a one-touch calendar spread We structured a bearish AUD/JPY view through a calendar spread of one-touches (short a 3m one-touch put, long a 6m) to capture the good-bad duality in Trump's policy platform.

Initiated shorts in 3m/longs in 6m AUDJPY 78.0 one-touch puts in 0.69:1 notional for net premium 31.0%. Marked at -6.9%.

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX