The most focused on the political event in Euro area this year — the French elections are approximately a month away. Our forecast assumes that mainstream parties prevail, which combined with a less dovish ECB should eventually result in EUR strength.

Well, what happens if Len Pen loses? The euro might only rally 2 to 3 cents on short covering since the base is small (refer above chart).

Moreover, maybe some investors will simply shift focus to Italy. But if Italian elections might be a year away, markets will move in the interim.

The wildcard is cross-border equity flows, which have looked weaker for several months than what Europe’s cyclical environment justifies.

We are less confident on precisely how much inflow might materialise since Italian politics will always deter some investors.

So for now, consider equity positioning a source of euro upside risk rather than a necessary condition for outperformance, for now, ECB policy seems to be more critical.

OTC outlook and Options Strategy:

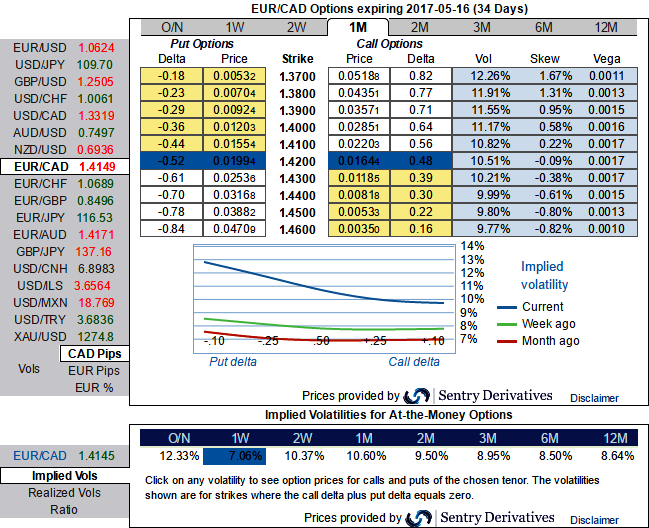

Please be noted that from spot rates, the 1w IV skews are fairly distributed alongside the ITM and OTM strikes and IVs are just shy above 7% which is on the lower side, it is a good news for put writers.

While drastic spike 10.6% in 1m tenors, where positively skewed IVs are indicating the hedgers’ interests in OTM put strikes. This implies hedging sentiments for the bearish risks in the underlying spot. Hence, put option holders would be on upper hand of these tenors.

At spot ref: 1.4123 (while articulating) we advocate below FX derivatives strategy as we favor optionality to the directional trades. For the bearish streaks that we are inclined to position a partial retracement of the down move throughput ratio back spreads (PRBS), as calling the bottom is difficult and adding directional spot exposure is risky at the moment.

Alternatively, using any abrupt rallies writing any overpriced OTM puts is a wise idea. Thus, you decide to initiate a diagonal put ratio back spread (PRBS) at net debit.

Execute strategy this way, initiate shorts in 1W (1%) out the money put with positive theta, simultaneously, buy 2 lots of 1M (1%) in the money -0.66 delta put option. Establish this option strategy if you expect that EURCAD would either expect sideways or spike up abruptly over the next near future but certainly not beyond your upper strikes.

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data