The US dollar was unable to benefit on a sustainable basis from the prospect of a truce in the trade conflict between China and the US. We find that hardly surprising as we assume that the inflation risks in the US would rise all the more notable, the stronger the protectionist measures turned out to be which the US administration was to implement. Rate expectations would have to rise more notably, as we are convinced that the Fed might overcompensate for the rising inflation expectations so as to fulfill its mandate of price stability.

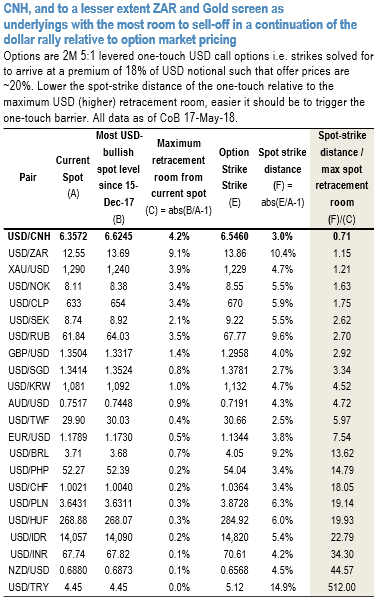

Amid this scenario, USD calls are cheap relative to spot retracement headroom in CNH, and to a lesser extent ZAR and gold. 6M-1Y EURUSD vols are decent buys amid broad USD strength and re-emergence of political risks (Italy).

Best value USD calls: Judging from the number of queries on the topic recently, real money investors are increasingly beginning to devote option premium to hedge against a continuation of the dollar rally.

To this end, above nutshell presents a simple relative value screen for short-dated one-touch (OT) USD call options that provide highly leveraged exposure to dollar strength.

The rich/cheap measure for directional (not delta-hedged) options used in the table is the ratio of spot-strike distance of 2M 5X geared (i.e. 20% price) OTs deflated by the maximum retracement headroom for the dollar since the onset of the USD downtrend in mid-December; smaller the ratio, less the heavy lifting required of spot to trigger the maximum option payout.

Currency Strength Index: FxWirePro's hourly USD spot index has shown -82 (which is bearish), while hourly EUR spot index was at 72 (bullish) while articulating at 10:13 GMT. For more details on the index, please refer below weblink:

http://www.fxwirepro.com/fxwire/currencyindex

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays