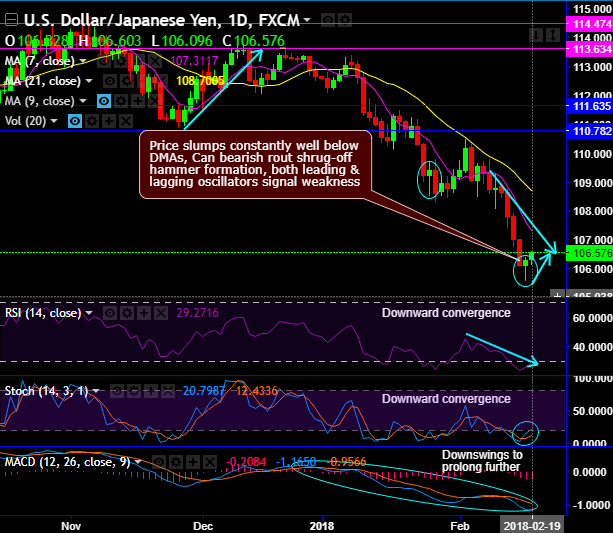

Chart pattern: USDJPY price slumps constantly remained well below DMAs despite today’s rallies. Hammer pattern has occurred at 106.272 levels that have shown mild upswings today.

Can bearish rout shrug-off hammer formation is a dubious question, both leading & lagging oscillators signal weakness (refer daily chart).

Big Bearish real body candles evidence dips below EMAs, price slumps slide below long lasting range & breaches 38.2% Fibos, both leading & lagging indicators signal weakness.

Stiff resistance zone is observed at 107.272 areas (i.e. 38.2% Fibonacci retracement), we’ve seen the strong demand zone at this juncture couple of times in the recent past which would now act as a stiff resistance.

Thereby, you could observe that the momentum in the previous bullish swings is shrinking away.

Both RSI & stochastic curves are indecisive on monthly and signaling selling pressures on minor and major terms.

While the trend indicators (7&21 DMAs) have also been indecisive but MACD signals downswings to prolong further.

Trading tips: Contemplating above technical rationale, we advocate buying boundary binary options with upper strikes at 107.011 and lower strikes at 105.557, this strategy is likely to add magnifying effects to the yields as long as the underlying spot FX remains between these two strikes on expiration. Alternatively, one can short futures contracts of mid-month tenors with a view to arresting further downside risks.

Currency Strength Index: FxWirePro's hourly USD spot index has shown 5 (which is absolutely neutral), while hourly JPY spot index was at 49 (bullish) while articulating at 06:44 GMT. For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit: