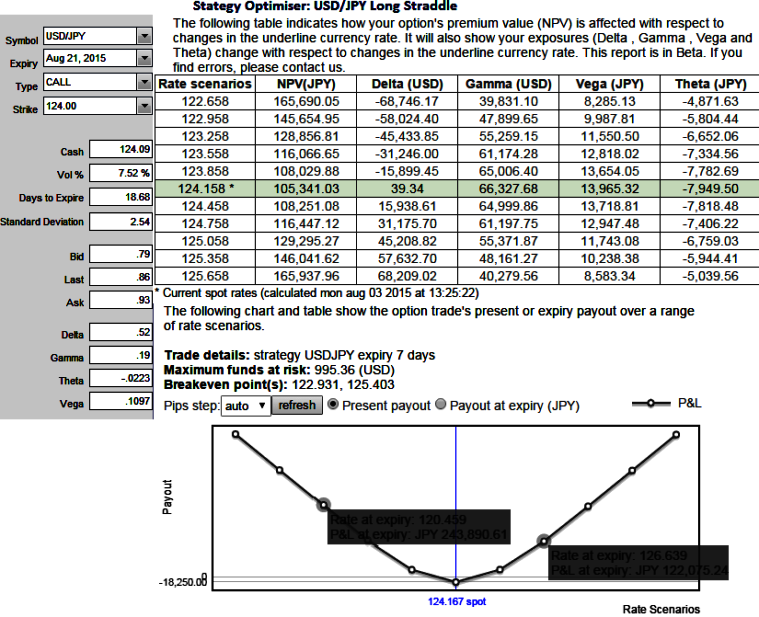

This recommendation must be quite baffling for the one who referred our earlier write up on USD/JPY on speculation grounds. If on a short straddle combination where a call and put options are written with delta's of 0.50 and -0.49 respectively how can this execution be delta hedged? The position is 1 of each written (underlying exchange price at 124.060 and ATM strike price at 124.050 with 7 days maturity).

As you can this from above charts the computation of the delta of the long straddle position is almost neutralized (closer to zero) and then a position in the underlying currency with -1*delta of the derivative position. Then have arrangements for adjusting the hedge so that it moves with the delta of the derivative position.

There is a reason for doing this, as the pair is perceived to be in range bounded and those who've taken this long straddle position can go for this arrangement by taking outright positions in spot Fx market but the person who has to ask how to do it doesn't know that reason. Write a straddle and you are short gamma and vega. You were delta hedging a position that is all about gamma and vega, all our bells and whistles would go off.

FxWirePro: USD/JPY delta hedging of long straddles for long term foreign traders

Monday, August 3, 2015 8:22 AM UTC

Editor's Picks

- Market Data

Most Popular

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings