USD/JPY rebuilt some upside momentum in November as US rates markets moved to re-price a December Fed hike, but the risk-off markets in early-December pulled it back to the middle of the recent range.

Forecasters are losing faith in JPY weakness and for the first time in at least five years, consensus forecasts are not calling USD/JPY higher, with both Bloomberg's and Reuters' analyst surveys now showing a profile essentially flat at spot.

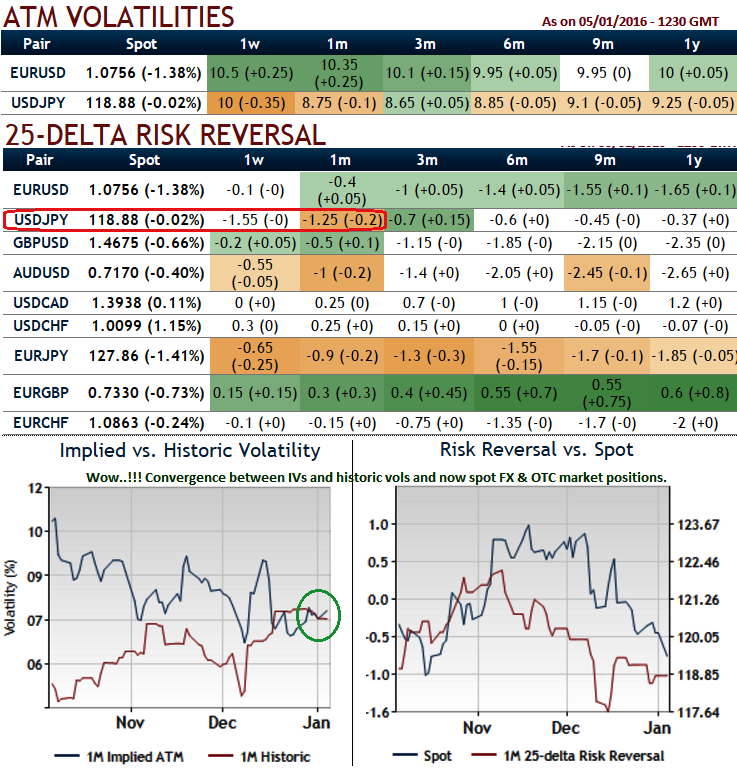

For us, it would be in narrow range of 125.959 - 116.0.82 but slightly bearish bias, the 25-delta risk reversals of USDJPY are at the highest negative figures among entire G20 currency space for next 1w-1m or so, but it is reckoned that any abrupt upswings in short run could be exploited for shorts.

This would mean that market sentiments for this pair have been bearish in medium term despite eyeing on any abrupt upswings for shorting opportunities.

As a result, Yen may pretty much gain out of lots of uncertainties such as Chinese slowdown, to confirm this fear Caixin services PMI has dropped from previous 51.2 to 50.2 to miss the forecasts at 52.3.

On the other hand, it is also understood that ATM contacts of USDJPY have gradually reduced implied volatilities after the much awaited fed's season which has evidenced anticipated rate policy that was factored in already and has propped up a little leftover strength in dollar soon after the event.

For now, you get to know that from how OTC markets are positioned and order flow basis as to determine which direction the underlying spot FX is heading towards, don't get trapped as it is certain that fed hike of 25 bps has already been fairly positioned and priced in especially hard currency pairs such as USDJPY, yen's gains in medium run are very attractive.

Also observe how the historic vols & IVs and spot FX market positions and OTC sentiments are converging, this would mean that these computations are likely to direct the underlying market southwards for next 1 month.

FxWirePro: USD/JPY OTC positions divulge bears victory in stiff tug of war

Wednesday, January 6, 2016 6:51 AM UTC

Editor's Picks

- Market Data

Most Popular

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX