After bulls losing momentum in the pair yesterday at the highs of 0.9789, prices tumble today of US elections whereby Trump almost in the leading the contest.

Observe a bearish engulfing candle with the big real body to signify the weakness in this pair.

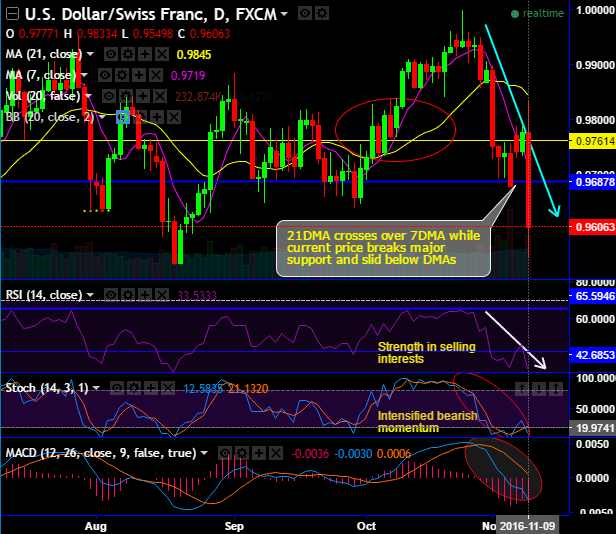

21DMA crosses over 7DMA while the current price breaks major support at 0.9687 and slid below DMAs.

Price has begun sliding below EMAs also on monthly terms after a whipsaw pattern at the strong support of 0.9693 marks.

You could also observe the shrinking buying momentum as the leading indicators on this timeframe evidences bearish convergence to the considerable price declines.

While for major bearish trend, MACD's bearish crossover is substantiating the trend is likely to prolong further.

On a broader perspective, the major bearish trend has been declining towards next strong supports of 0.9418 levels, more evidently after the break out below this strong support synthesizing with bearish indications by both leading and lagging oscillators.

Hence, at spot ref: 0.9606 we advocate arresting these bearish risks by initiating shorts in futures contracts of mid-month expiries.