USDCAD bulls have been supported by 50% Fibonacci retracements levels from the peaks of 1.4689 levels, while 21-EMAs are supportive to the bears in the corrective mode.

Please be extra keen on last six months’ price behavior, although the intermediary bulls have managed to test the strong support at 50% Fibonacci levels, the rallies have been restrained below 21EMA levels couple of times in this span.

Strong supports were seen at 1.2068-1.1925, observe sharp rallies as the pair touches these levels, this event has happened twice in last two and half years. But in last 6-months, the prices have collapsed as and when it approached 21EMA levels. The same incidence has happened even in in this month’s price action.

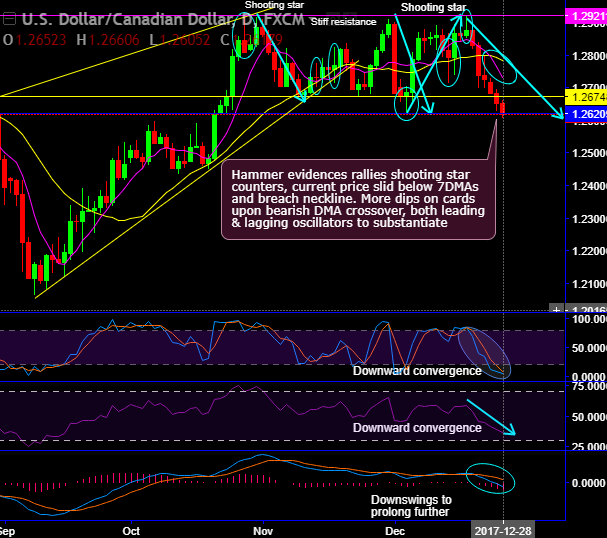

While in the short term trend scenario, the pair has formed the triple top pattern with top 1 at 1.2916, top 2 at 1.2909 and top 3 at 1.2920 levels with the neckline at 1.2674 levels.

Thereby, you could observe the stiff resistance at 1.2921 levels, that’s where shooting star pattern candle has occurred, consequently, considerable price dips have slid below DMAs.

For now, more price slumps seem to be on cards as 7DMA crosses below 21DMA which is the bearish crossover.

Well, let’s not isolate this analysis, to substantiate this bearish stance, both leading oscillators (RSI and stochastic indicators) converge downwards constantly to the ongoing price dips that signal the intensified momentum and strength the prevailing bearish sentiments. Same has been the case in monthly terms.

Most importantly, MACD’s bearish crossover also indicates the extension of selling rallies.

Contemplating above technical rationale, at spot reference: 1.2620, it is wise to snap deceptive rallies to deploy tunnel spreads with upper strikes at 1.2660 levels and lower strikes at 1.2590.

Alternatively, we advocate deploying shorts in futures contracts of near-month tenors with a view to arresting further potential bearish risks.

Currency Strength Index: FxWirePro's hourly CAD spot index is inching towards 123 levels (which is highly bullish), while hourly USD spot index was at -90 (bearish) while articulating (at 11:19 GMT). For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?