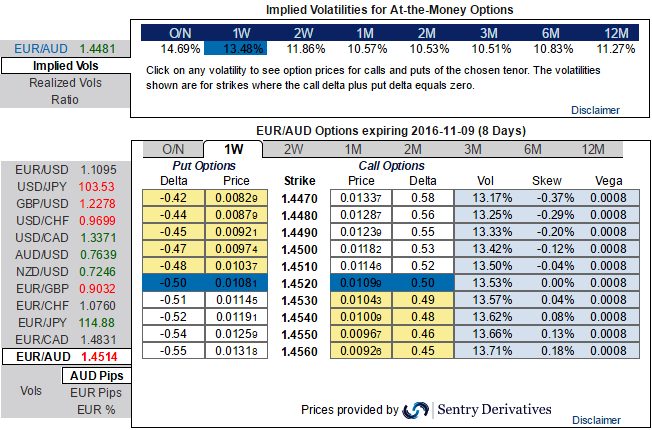

The implied volatility of ATM contracts for next 1m-3m expiries of this the pair is flashing at around 10.5%, that is when vital economic data events took place in the euro area.

Euro area composite PMI post a solid gain in October, signaling 1.8% GDP growth, but manufacturing PMIs have missed the forecasts (actual at 53.5 versus forecasts at 55.3).

The improvement was broad-based by sector and country and was reinforced by IFO and EC surveys.

Next week’s 3Q16 flash GDP report to show 1.5%q/q, SAAR growth, with modest downside risk.

October flash inflation report to show core inflation stuck at 0.8% oya.

From almost last two-three weeks we've been seeing the prices of this price sensing strength amid the major downtrend (see technical charts for EURAUD bottoming out from 1.4255 to the current 1.4477 levels).

If you consider long term euro's valuations then you would come across the convergence between spot curve and risk reversals.

EURAUD hedging and speculating sides as per OTC adjustments:

With spot FX flashes of EURUSD at 1.4477, IVs for 1w and 3m contracts have slightly shown a resilience in short run shrinking in the medium run. While positively skewed IVs of 2w tenors signify the OTC market sentiments towards OTM call strikes.

Hence, contemplating these OTC factors and synthesizing them with the technical trend and fundamental factors we understood the following fact.

The current spot prices are expected to show strength and travel upwards in next 1 months times but we are not jumping the guns to conclude this as the bullish reversal, In foreign exchange (FX) market prices move to extremes more frequently and these extreme levels is referred to as “Fat Tails”.

If more price actions occur at the fat tails, the option trader would mark volatility higher for out-of-money (OTM) and in-the-money (ITM) options then at-the-money (ATM) options and so does happen with EURAUD pair currently.

FX option strategies:

So, on both hedging and speculative grounds the strategy goes this way, go long in 1W ATM striking puts, while going long in 1M ATM strikes of 50% deltas.

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close