OTC Outlook:

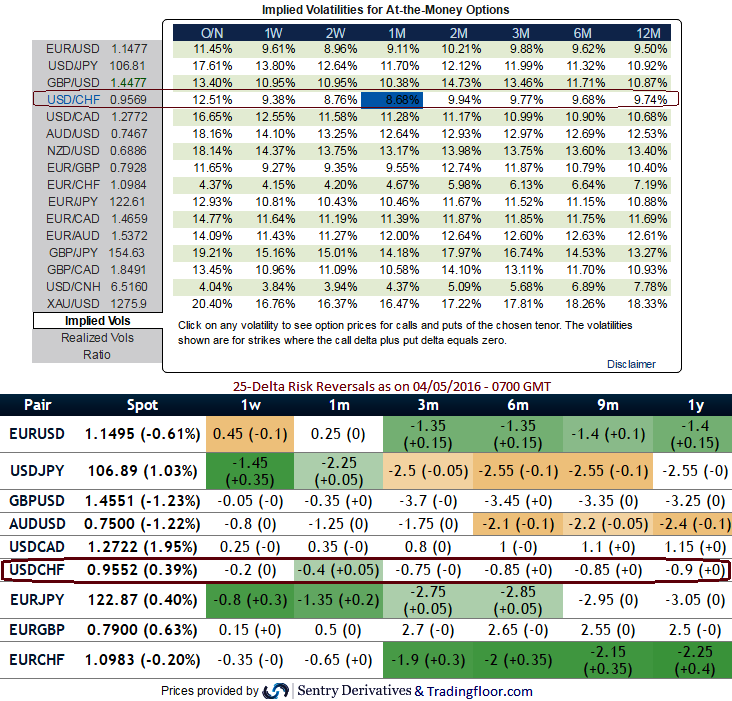

ATM implied volatilities are considerably shrinking away, slipped below 9% (to be precise 8.76% for 2W expiries and 8.68% for 1M expiries).

While, risk reversals have also been in sync with IVs and spot FX movements,

We see no significant changes in bearish hedging sentiments in OTC FX market of this pair as these numbers also have been bearish neutral for next 1-3 months or so.

25-delta risk reversals evidence no disparity in volatility and prices, between puts and calls on the most liquid out of the money (OTM) options quoted on the OTC market.

FX Option Trading Tips:

Contemplating on IVs and risk reversals, we USDCHF continues to slide but certainly shows spikes in between, as result we could foresee some sort of either sloping or range bounded trading opportunities in prevailing range of 1.0096 and 0.9306 levels in next 1-3 months or so.

So those who believe it can still be possible to pull out returns from this unsure scene from this pair while IVs are shrinking away, even though exhausted bulls who think long lasting non-stop streak of Bull Run to take halt at this point, then iron butterfly option strategy offers such opportunities.

To execute this strategy, the option trader assumes long on a lower strike Out-Of-The-Money put and shorts At-The-Money Put simultaneously short again on At-The-Money call and long on Out-Of-The-Money call, this results in a net credit to put on the trade.

Well, at spot ref: 0.9555, iron butterfly strategy (EUR/CHF) can be executed as shown below,

Long 2M (1%) OTM -0.36 delta Put & Short 1W ATM Put with positive theta + Short 2W ATM Call with positive theta again & Long 2M (1%) OTM 0.37 delta call.

In iron butterfly, there is high probability of deriving certain yields as it contains both bull call and bear put spreads, hence it would likely yield variant payoffs from classic butterfly spreads.

We preferred narrowed strikes on short side as we expect mild upswings in near terms, thereby, short puts are most likely to derive certain yields and thereafter, spot FX should keep dropping again in next 1 week’s time, well these two shorts cushion the cost of long options.