The projection for Mexican peso (MXN) remains on higher side at 20.0 level for end-2020 but still see scope for carry to dominate. MXN longs remain high but resilient as investors continue to seek out high-carry EM currencies. Pemex risks are our main concern, but these are more likely to weigh on MXN and market participants in 2Q’20, given that it seems the quasi-Sovereign has received sufficient funding for coming months.

MXN seems to have gained more permanently from lessened China-US trade, and could gain further from the ratification of the USMCA. Mexico’s trade balance has remained in surplus territory, illustrating more clearly that Mexico has gained perhaps structurally from less China-US trade, despite weak manufacturing set to hurt Mexico activity in the medium-term. (The US import substitution away from China and to Mexico occurred mainly in motor vehicles and machinery/equipment. Combined, these two sectors account for about 70% of Mexico’s manufacturing exports.) Market focus on the potential passage of USMCA through US Congress could also support MXN in the near-term, although this remains uncertain in light of the incoming US elections and US Congress Chair Pelosi’s priorities with president Trump’s impeachment. We believe current MXN valuations mostly price in its passage in our view. Nevertheless, it could bolster some macro optimism for higher investment into the country.

OTC Updates and Options Strategies:

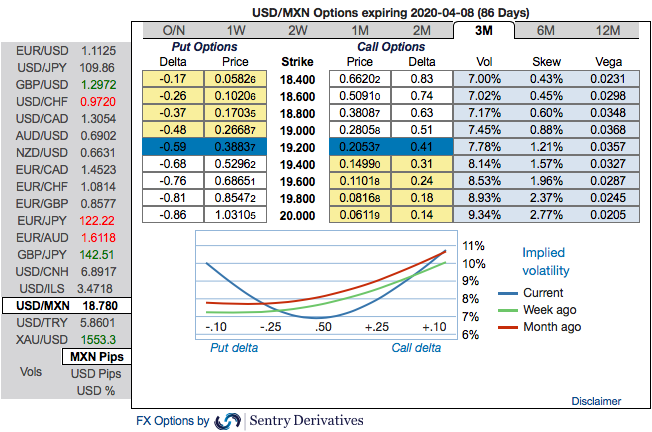

Please be noted that the positively skewed IVs of USDMXN of 3m tenors have been well-balanced but slightly biased towards upside risks, while IV remains on lower side and it is perceived to be conducive for options writers.

It is analysed that earning theta without taking left tail risk via high beta ratio call spreads. Such structures are covered to a fair extent against spikes of high beta volatility given the long risk-reversal sensitivity embedded in the structure.

Considering the current MXN skew setup and the receding risks for MXN spot we are open to taking the gamma risk in order to more efficiently reap the extra OTM vs ATM premium on MXN put side. 1*1.5 MXN ratio put vol spreads have shown strong and almost equivalent systematic returns for USDMXN and EURMXN over last few years.

3M USDMXN ATM/25D 1*1.5 vol ratio call spread vs 10.45/10.65 indicative.

3M EURMXN ATM/25D 1*1.5 vol ratio call spread @9.45ch vs 10.5/10.75 indicative. Courtesy: Sentry & JPM

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms