Sterling has been the underperformer among G10 FX space, thanks to the chaotic Brexit process to date. The Q1 outlook for the cross is binary: either a friendly Brexit or not.

While the UK government has cancelled a parliamentary vote on the divorce settlement. UK Prime Minister May is to go to Brussels to renegotiate. One of the many EU presidents (Tusk this time) has said the EU will not renegotiate but it will help get ratification which sounds a bit like a soft renegotiation.

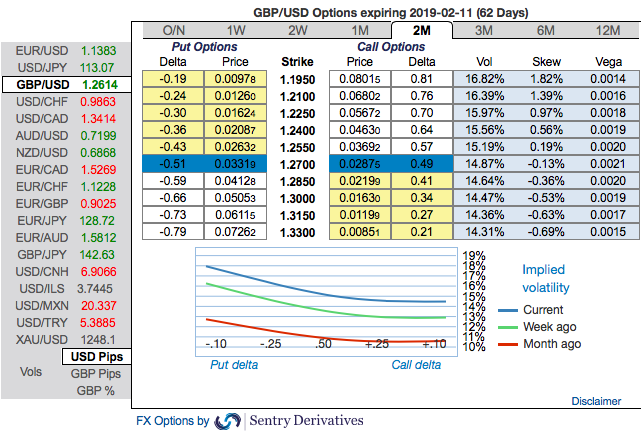

OTC hedging updates: Please be noted that the positively skewed IVs of GBPJPY of 2m tenors signify the hedgers’ interests to bid OTM put strikes upto 134 levels (refer above nutshells evidencing IV skews).

As both interpretations make sense they are balancing the spot market and GBP spot levels are reacting hardy at all. Only volatility is increasing.

It remains more expensive to hedge against strong GBP depreciation, which means that an orderly Brexit in whatever shape is still seen as being more likely. However, the risk of things going wrong is high and as a result, we regard any GBP appreciation with much scepticism.

Although you are seeing risk reversals showing fresh positive bids to the existing bearish setup, while the positively skewed GBPUSD implied volatilities of 2m tenors still signal bearish hedging sentiments. To substantiate this downside risk sentiment, risk reversals have also been in negative territory adding minor negative bids in the short-run. We see less volatile swings in GBPUSD, if you plot weekly technical chart.

Currency Strength Index: FxWirePro's hourly GBP spot index is showing -24 (which is mildly bearish), while USD is flashing at -4 (which is neutral), while articulating at (09:40 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes