GBP is the poorest performing major currency this past month as the market flipped the BoE from the vanguard to the rearguard of expected central bank policy normalization (the GBP NEER fell by nearly 3%).

The news flow was not universally negative –the government has moved to acknowledge the need for a lengthy Brexit transition that defers any economic adjustment for a number of years beyond the formal exit in 2019 –but weak cyclical developments are taking precedence.

In other words, the reality of a soft economy matters more for the near-term direction of the exchange rate than the expectation of a softer Brexit.

The long-term risk to GBP from a disruptive Brexit has diminished as most players in the government now accept the need for a transitional deal that will ensure very little changes on the ground for a handful of years after 2019.

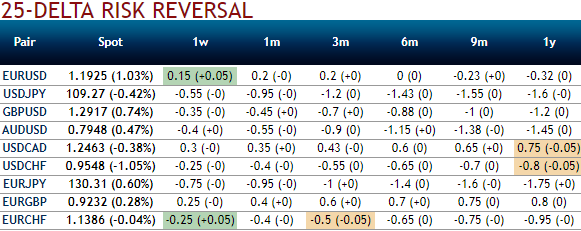

Consequently, OTC indications for Sterling divulge many intricacies, GBPUSD USD now appears to be out of the limelight but certainly not out of the woods. Please be advised that the 25-delta risk of reversal of GBPUSD has not been indicating any dramatic shoot up nor any slumps but bearish neutral (no fresh change in risk reversals has been observed), but seems to be one of the pairs to be hedged for downside risks as it indicates puts have been relatively costlier.

The risk reversal curve has been traveling in a linear direction, while spot curve is slumping downwards back to converge with the RR curve. While positively skewed IVs signify the hedgers' interests in OTM put strikes upto 1.25 levels.

While implied volatilities across all tenors have been shrunk massively. Sterling fell pretty much with interest rate expectations after the vote to leave the EU in June. If we look at 3m futures contracts, there’s been a 60bp shift in relative pricing of where rates will be in a year’s time that reflects consensus now that fed funds will be at 1-1.25% in December 2017, while UK rates will be unchanged at 0.25%. This is in line with our forecasts and points to a period of relative calm for the pound (which is currently seeing some much-needed short-covering) before the economic implications of leaving the EU to become clearer.

While the cable volatility surface has returned to levels seen at the start of the year overall, but risk reversals and butterflies are now excessively cheap: - The sell-off in the cable skew is exaggerated compared to ATM volatility, since the risk remains asymmetric on the downside; - The tail risk is mispriced, as the GBPUSD butterfly now seems to be less expensive than earlier, which is unsustainable given the GBP extra tail risk.

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise