The currency market has been acting as the adjustment factor between countries positioned at different parts of the economic cycle clock. It has been one of the few assets on which carrying long volatility positions has not been a constant pain. It has also led to a dramatic reversal in the correlation regime, leading to some significant discounts on equity options contingent to currency levels.

FX vols have almost entirely retraced their peak-to-trough jump as the VIX spike of early February has subsided, but are entering March with a renewed bid under the cloud of trade tensions. Aside from the yen for which the direction of travel is clearer than elsewhere, most other USD pairs are subject to cross-currents of US twin deficits, a potentially more-hawkish-than-expected Fed, and negative trade-related headlines, hence it is unclear whether options will receive enough directional sponsorship from an unambiguous dollar trend to send implied vols spiraling higher as happened in January.

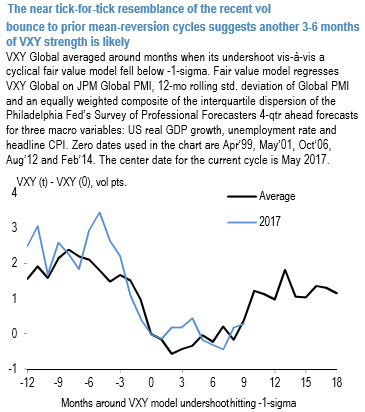

At the same time, a choppy range in the dollar should arrest the decline in realized volatility following the VIX shock, and VXY should remain in the ascendant track of its typical recovery pattern from cyclical troughs for the next 3-6 months (refer above chart). Net-net, the bar for vol selling is high in this climate, but we are not averse to selective RV constructs that take advantage of the cheapness of EUR/high-beta cross vols.

We also favor positioning for a muted dollar environment via soft short USD-correlation structures such as vanilla USD-JPY-NZD correlation triangles that net collect premium but with the hedge protection of a high-beta cross-yen leg. Given the historical precedent of de-coupling between reserve and commodity/carry currencies during trade conflicts, owning select EUR-and JPY cross vols that benefit from such a wedge is perhaps the cleanest theme at present; we are already positioned for this through GBPJPY – USDJPY and BRLJPY – USDJPY vega spreads, and add a soft, net premium-earning version of the same through a correlation triplet. Courtesy: JPM

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes