Everywhere across the globe trade tariff related talks are heated debate. The news that China was looking into using a devaluation of the renminbi as a tool in case the trade conflict with the US was going to escalate, caused some movement on the markets for a brief moment yesterday. But the situation calmed down again quite quickly not least because both the US and China had sounded more conciliatory recently, which makes an escalation seem less likely. But in any case how much sense would it make to react to US import tariffs with the depreciation of the currency? Could a trade war lead to a currency war?

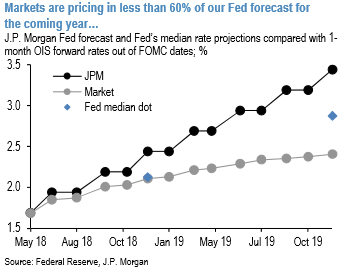

Away from the burgeoning trade concerns, we remain bearish on duration. Though markets remain somewhat well priced for this year’s Fed outlook, OIS forwards continue to underprice our Fed forecast into 2019, and we think this gap should close over time, as above-trend growth through 2018 leads to further tightening in labor markets and firming in inflation. Right now markets are pricing in only two full hikes and approximately a 25% probability of a third between now and March 2019, while we project four over the same period (refer above chart).

Importantly, next week’s CPI report should show further firming: we project that with last year’s -0.1% March reading dropping out of the 12-month window, the core over-year-ago run rate should rise to 2.1%, its firmest rate since February 2017.

As we discuss below, we have found that Treasuries have become increasingly sensitive to inflation surprises, and any further firming should push yields higher as markets price in more Fed tightening over the coming year. Given this mispricing and that 3-year yields have tended to rise one for one with increases in year-ahead Fed expectations, we recommend maintaining shorts in the 3-year sector.

Elsewhere, back-end USDJPY vols have not responded to the uptick in interest rate volatility and the breakdown in rates/FX correlations this year. 5Y ATM vols screen as cheap relative to contemporaneous drivers (3 vol pts.) as at their extreme in early 2008.

We explore auction cyclical trading strategies. The expiry curve in swaptions has been slow to react to improving liquidity conditions. Volatility supply for 1Q’18 was heavy but likely front-loaded; various factors point to slowing supply going forward. Courtesy: JPM

Currency Strength Index: FxWirePro's hourly USD spot index is flashing at -109 levels (which is bearish) while articulating (at 09:27 GMT). For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed