Mixed bag of economic flashes in Euro area, Inflation back in negative territory, GDP misses forecasts

Macro Outlook:

Euro zone GDP growth outperforms the US and UK in Q1 but reduced from its previous prints and misses forecasts, prints at 0.5% (Q1) versus 0.6%, supported by strong domestic demand

Growth is set to moderate in Q2, however, while annual headline inflation has returned to negative territory.

But, the current dynamics open the door to further EUR/GBP downside towards 0.7750 or below.

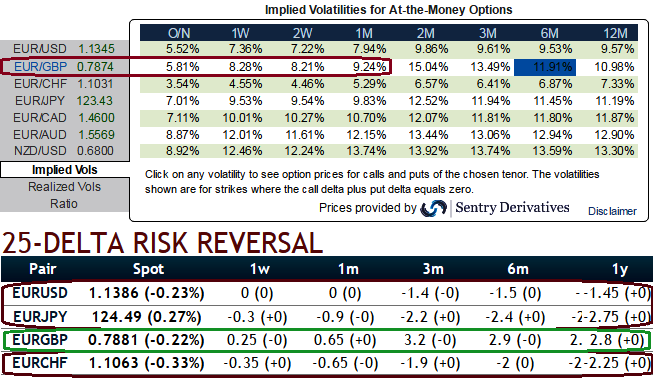

Expression - Sell downside volatility before the risk event (see IVs for 1W, 2W & 1M tenors).

The ECB is focusing on implementing existing stimulus measures for now, but more easing is possible later in the year.

Given the remaining uncertainty and the conditional nature of the event, a tactical bearish trade should be implemented via options.

Volatility is likely to gradually normalize approaching the vote, accompanied by GBP topside momentum and some deflation of the risk premium.

We favour the 6w expiry to benefit from the current unwind, thus avoiding direct exposure to the outcome and enjoying better liquidity on the volatility market.

Mechanics:

Buy EUR/GBP 1M put spread 1x2, strikes 0.77/0.75

Indicative offer: 0.58% (spot ref: 0.7750)

This put spread ratio positions meant for a moderate downside move and will benefit from further normalization in the volatility space.

The structure generates leverage between 4x and 5x if the spot trades close to the 0.75 strike at the 4w expiries.

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields