Yellow metal for December delivery on the Comex division of the NYME touched an intraday peak of $1,361.50 a troy ounce. It was last at $1,360.25 by 06:58GMT, up about $13.55, or 1.01%.

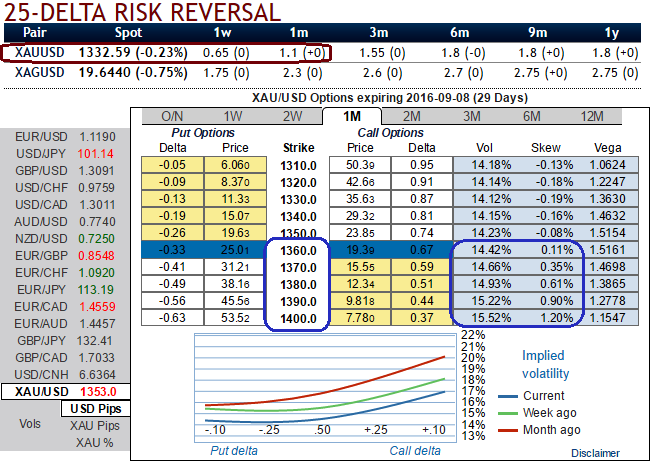

Let’s just have a glance over gold’s ATM contracts, from positive risk reversal flashes you can probably figure out hedging operations for upside risks in this precious metal both in a short run and long run, while 1m IV skews also signify the hedging interests in OTM call strikes.

The same cost does not mean the same risk profile; there is no free lunch in financial, commodities or bullion markets: the cheaper an option strategy, the riskier it is.

However, the statement is purely quantitative while appreciation of risk is to a large extent a qualitative issue.

The US dollar retraced Friday’s gains. As expected the strong labour market report hasn't been a game-changer for the majority of market participants as far as US rate expectations are concerned. The majority still considers a Fed rate hike until year-end to carry a likelihood of less than 50%.

We consider a risk reversal (RR) strategy long ATM call and short OTM put at a reasonable cost. The strategy has unlimited topside gain and downside loss.

Gold prices are forecasted in bullion markets to rise cuttingly, extending gains from the prior session as investors reevaluated the likelihood that the Federal Reserve will raise interest rates this year.

Fed funds futures prices showed traders now see a 40% chance of a U.S. rate hike by December, according to CME Group's Fed Watch tool. That compares with around 50% ahead of the report. September odds were at around 15% early on Wednesday, down from 20% a day earlier. Gold price is highly sensitive to moves in U.S. rates, which in turn considers many macro and micro economic factors, today’s US unemployment claims is major focus which is forecasted to rise to 272K from the previous flash at 262K.

Alternatively, one can buy the OTM call only at a cheaper cost, but with a topside knock-out barrier (an RKO call) with a level set such that the exotic option has exactly the same cost as the RR strategy initially considered.

This time, the risk is limited to the premium, but at some point, the gains can definitely disappear. While they have the same cost, these two risk profiles can hardly be more different for an investor.

There is an infinite number of ways to obtain a given expected gain, and therefore an infinite number of non-equivalent strategies with the same cost. So, how do we meaningfully discriminate strategies if cost is not a reliable indicator?

The cost of an optional strategy is merely the average of all its possible payoffs, weighted by the probabilities that the market attaches to the corresponding scenarios, so please be mindful all these aspects while constructing option strategies.

China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge