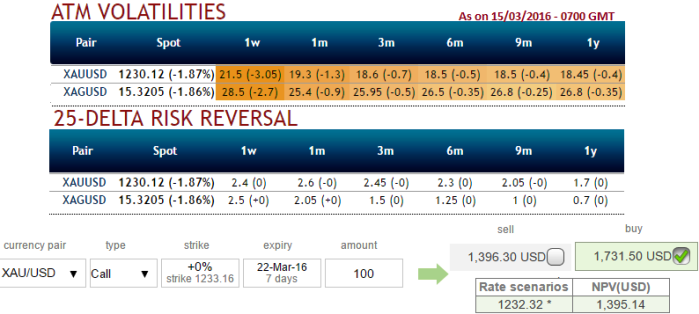

Let's begin glancing on implied volatility and risk reversal nutshell as it evidences a considerable dip in both values ahead of tomorrow's Fed's interest decision that is likely to remain on hold.

1W ATM IVs steeps down about 3 and odd percent and reducing gradually over the longer tenors.

ATM Call premiums of 1w expiries are trading 23.94% higher than NPV, whereas ATM IVs of same expiries have reduced to 21.5%, so there exists the disparity between IVs and option pricing.

Technically, the precious yellow metal could not hold onto trend line resistance at 1283.77 and slid below.

Trend has seen more than 61.8% retracement from the highs of 1920.80 in recent history, so what else is needed as it has now rejected below 50% fibo retracements and tight resistance at 1286 to target towards 1200.

Bears in Gold has wiped off buying interest and been tumbling consecutively from last couple of days but testing support at around 1225 levels firmly.

Contemplating above reasoning, for the traders who are risk averse, we like to recommend deploying either calendar call spread or zero cost collar whichever is suitable to the portfolio depending on quantum of spot commodity exposure, risk appetite and returns expectations.

Go long in 2M (mid month) (1%) out of the money call and simultaneously short 2W (near month) at the money call with positive theta value.

But always have this in mind that the shorting instruments with +ve theta to be analyzed with other option Greeks during selection of such short side options.

Alternatively, buying 1M protective at the money -0.49 delta put option while writing 3W (1%) out of the money calls with around 30+ Theta value is also recommended.

If you fear for shorting ATM call in the first strategy and perceived as a risky venture then the zero-cost collar is recommended to participate in the potential bull run on verge of Fed's event.

But for current technical situation as explained in our earlier post, these strategies can be employed to hedge the risks of spot commodity exposure.

FxWirePro: Reduced XAU/USD IVs and RR over 1.5% favor call writers - Calendar spreads for bullion hedgers

Tuesday, March 15, 2016 12:18 PM UTC

Editor's Picks

- Market Data

Most Popular