FX markets found a footing this week despite a shaky start. Following Trump’s announcement last week of 10% tariffs on the remaining $300bn of imports from China, trade tensions appeared to have escalated even further. China ordered a suspension of US agriculture purchases and the CNY fix on Monday indicated a bias for a weaker currency which shook markets and prompted the US to give China the designation a currency manipulator.

As trade tensions simmer, central banks have responded in a race to the bottom, as several of them cut rates pre-emptively given rising global risks. In G10, the prime example of this was the RBNZ who delivered a surprise 50bp rate cut (25bp was expected). In EM, India, Thailand, and Philippines all cut rates this week as well. The net result was that rates fell even more across the board. Within G10, the outperformance came mostly from currencies where the central banks have limited room to cut rates — EUR, SEK, CHF and JPY all outperformed.

The currencies with safe-haven sentiments only price in the growth revisions in hand thus far:

At this time, a perspective of defensive currencies appear fairly priced to only the growth outlook revisions that have occurred thus far and that additional growth vulnerabilities are not yet discounted (refer 3rd chart). The timelier indicators of growth momentum are still negative for nearly 2/3rdof the countries we cover so still indicating downside risks to growth.

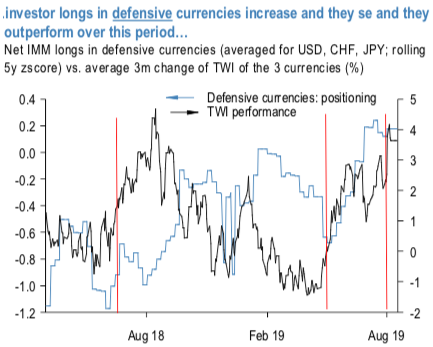

In addition, investor positioning does not appear to be that crowded yet (refer 4th chart). Investor positioning becomes more defensive in the subsequent months as well in JPY, USD and CHF longs typically increase (1st chart; blue line) while investor positioning in high beta FX tends to decline (refer 2nd chart; grey line); and staying short in antipodeans (AUD, NZD) and EUR; longs in safe-havens JPY, CHF.

The backdrop leaves us defensive on FX, although admittedly the combination of poor liquidity in August and headline risk will likely keep market moves erratic. We remain positioned along with the three themes of:

1) Short high beta FX where central banks are likely to keep easing and have the room to ease further (AUD, NZD),

2) long a combination of JPY, CHF, and JPY on trade tensions, soft global growth, and late-cycle dynamics, and

3) Short EUR vs CHF and JPY on ECB easing and poor growth (recent Italian political developments are unlikely to have a sustained impact on EUR; more on this below).

While you observe AUD’s underperformance in the medium-term perspective since August 2018, was majorly due to the cooler outlook for global growth, with China especially in focus, as well as growing expectations of RBA rate cuts. AUDNZD is extremely undervalued, according to interest rates and commodity prices, and there are early signs of a reversion towards fair value which could take the cross towards 1.0750 over the next few weeks. Courtesy: JPM

US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures